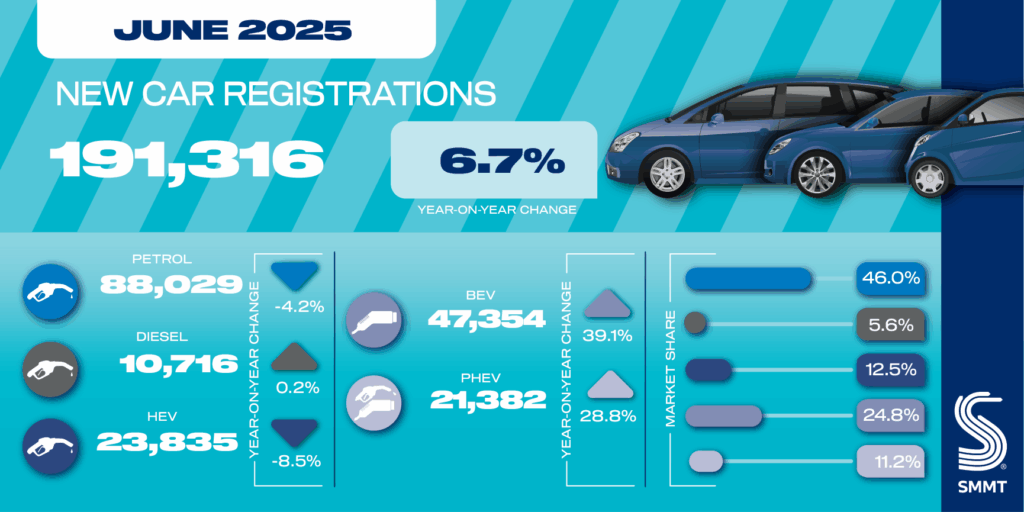

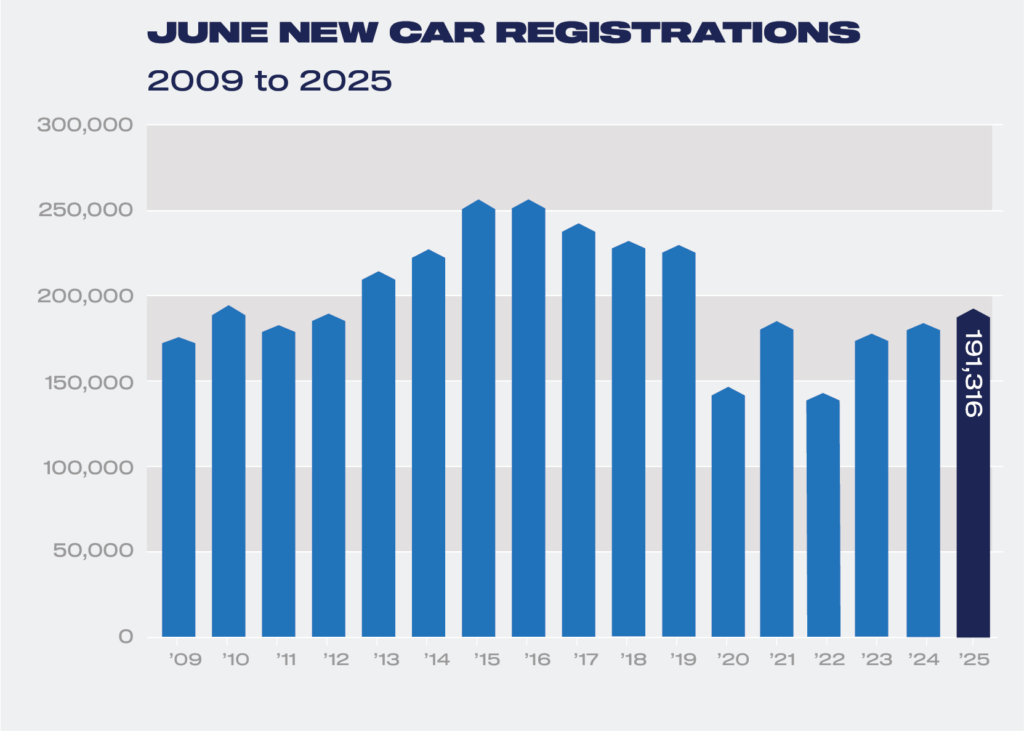

New automobile market up 6.7% in June to 191,316 items as producers use each channel to drive registrations to highest degree since 2019

The UK’s new automobile market grew for the second consecutive month in June, as registrations rose 6.7% to 191,316 items, based on the newest figures revealed right now by the Society of Motor Producers and Merchants (SMMT). It was the very best June since 2019, serving to elevate first half efficiency 3.5% above the identical interval final 12 months, though the market stays -17.9% behind pre-Covid ranges.1

June automobile registrations by gross sales

| June | |||||

| 2025 | 2024 | % change | Mkt share ’25 | Mkt share ’24 | |

| PRIVATE | 71,616 | 67,622 | 5.9% | 37.4% | 37.7% |

| FLEET | 114,841 | 105,871 | 8.5% | 60.0% | 59.1% |

| BUSINESS | 4,859 | 5,770 | -15.8% | 2.5% | 3.2% |

| 191,316 | 179,263 | 6.7% | |||

2025 automobile registrations by gross sales

| 12 months to this point | |||||

| 2025 | 2024 | % change | Mkt share ’25 | Mkt share ’24 | |

| PRIVATE | 402,004 | 382,879 | 5.0% | 38.6% | 38.0% |

| FLEET | 617,441 | 600,408 | 2.8% | 59.2% | 59.6% |

| BUSINESS | 22,774 | 23,476 | -3.0% | 2.2% | 2.3% |

| 1,042,219 | 1,006,763 | 3.5% | |||

Regardless of a constructive June efficiency, it too remained behind pre-pandemic ranges, -14.4% decrease than in 2019, and pushed largely by fleet exercise with uptake climbing 8.5% to 114,841 items.2 Personal retail demand grew 5.9% to 71,616 items however nonetheless accounted for simply lower than 4 in 10 new automobiles registered (37.4%). Enterprise registrations fell -15.8% to 4,859 items.

June automobile registrations by gas

| June | |||||

| 2025 | 2024 | % change | Mkt share ’25 | Mkt share ’24 | |

| BEV | 47,354 | 34,034 | 39.1% | 24.8% | 19.0% |

| PHEV | 21,382 | 16,604 | 28.8% | 11.2% | 9.3% |

| HEV | 23,835 | 26,055 | -8.5% | 12.5% | 14.5% |

| PETROL | 88,029 | 91,874 | -4.2% | 46.0% | 51.3% |

| DIESEL | 10,716 | 10,696 | 0.2% | 5.6% | 6.0% |

| TOTAL | 191,316 | 179,263 | 6.7% | ||

2025 automobile registrations by gas

| 12 months to this point | |||||

| 2025 | 2024 | % change | Mkt share ’25 | Mkt share ’24 | |

| BEV | 224,841 | 167,096 | 34.6% | 21.6% | 16.6% |

| PHEV | 107,039 | 81,522 | 31.3% | 10.3% | 8.1% |

| HEV | 146,777 | 134,660 | 9.0% | 14.1% | 13.4% |

| PETROL | 504,840 | 557,265 | -9.4% | 48.4% | 55.4% |

| DIESEL | 58,722 | 66,220 | -11.3% | 5.6% | 6.6% |

| TOTAL | 1,042,219 | 1,006,763 | 3.5% | ||

New petrol registrations declined -4.2% and diesel volumes have been flat (+0.2%), which means their mixed share of the market is now simply over half (51.6%), with whole electrified car registrations (92,571) reaching a 48.5% market share. Registrations of automobiles with plugs rose strongly as battery electrical automobiles (BEVs) jumped 39.1% to 47,354 items, equal to 1 / 4 (24.8%) of the market, and plug-in hybrid electrical automobiles (PHEVs) grew 28.8% to 21,382 items. The marketplace for new hybrid electrical automobiles (HEVs), in the meantime, fell by -8.5% to 23,835 registrations.

Throughout the primary six months of 2025 new BEV registrations have risen 34.6% to 224,841 items however, at 21.6% market share, they continue to be considerably behind the 28% mandated for this 12 months. Furthermore, reaching even this degree of market penetration has required reductions totalling £6.5 billion over the past 18 months.3 In a current survey of automotive CEOs carried out for SMMT’s new Automotive Enterprise Leaders Barometer, greater than half (55%) mentioned they imagine the UK is considerably behind plan to fulfill the 2030 finish of sale date for brand spanking new automobiles powered solely by combustion engines.4

An absence of governmental buy and charging incentives, mixed with fiscal disincentives such because the newly utilized VED Costly Automotive Complement (ECS), which is estimated to impose an efficient superb of greater than £360 million on BEVs purchased from April on this 12 months alone, are performing as a brake on BEV demand. Business bosses have reaffirmed this, citing fiscal incentives for personal BEV gross sales as the largest single motion wanted to spice up BEV demand, financial progress and the UK’s automotive manufacturing base – a key goal of presidency’s new Industrial Technique.4

Amending the ECS to take away nearly all of BEVs from its scope and chopping VAT on new BEVs and public charging would enhance demand considerably. This may additionally assist ship a vibrant home market, turning into a pacesetter not simply in decarbonisation however in affordability. If applied for 3 years, a further 267,000 BEVs – somewhat than fossil gas automobiles – could be placed on the highway, driving down CO2 emissions by six million tonnes a 12 months.5

Mike Hawes, SMMT Chief Government, mentioned, “A second consecutive month of progress for the brand new automobile market is sweet information, as is the constructive efficiency of EVs. That EV progress, nevertheless, remains to be being pushed by substantial trade assist with producers utilizing each channel and unsustainable discounting to drive exercise, but it stays beneath mandated ranges. As now we have seen in different international locations, authorities incentives can supercharge the market transition, with out which the local weather change ambitions all of us share might be beneath menace.”

High fashions Could

| June | ||

| 1 | Nissan Qashqai | 5,008 |

| 2 | Ford Puma | 4,419 |

| 3 | Tesla Mannequin Y | 4,181 |

| 4 | Vauxhall Corsa | 3,583 |

| 5 | MG HS | 3,567 |

| 6 | Tesla Mannequin 3 | 3,538 |

| 7 | Get Sportage | 3,376 |

| 8 | Volkswagen T-Roc | 3,295 |

| 9 | Nissan juke | 3,278 |

| 10 | Peugeot 2008 | 3,212 |

High fashions 2025

| 12 months-to-date | ||

| 1 | Ford Puma | 26,355 |

| 2 | Get Sportage | 23,012 |

| 3 | Nissan Qashqai | 22,085 |

| 4 | Vauxhall Corsa | 20,128 |

| 5 | Nissan juke | 18,527 |

| 6 | Volkswagen Golf | 16,884 |

| 7 | MG HS | 16,115 |

| 8 | Hyundai Tucson | 15,496 |

| 9 | Volvo XC40 | 15,267 |

| 10 | Volkswagen Tiguan | 15,223 |

- June 2019 – 223,421 registrations

- YTD 2019 – 1,269,245 registrations

- SMMT calculations primarily based on Auto Dealer information on EV reductions, JATO gross sales weighted really helpful retail value information and SMMT EV market information and own-estimates of fleet reductions.

- SMMT evaluation – UK Automotive Enterprise Leaders Barometer 2025 – a survey of CEOs and MDs undertaken between April and Could 2025, with greater than 50 respondents representing companies with a mixed £79 billion turnover and 87,000-strong workforce – representing 98% of UK car manufacturing. 35% of respondents have been car producers, 40% provide chain companies and 25% different auto firms.

- SMMT calculations.

SOURCE: SMMT