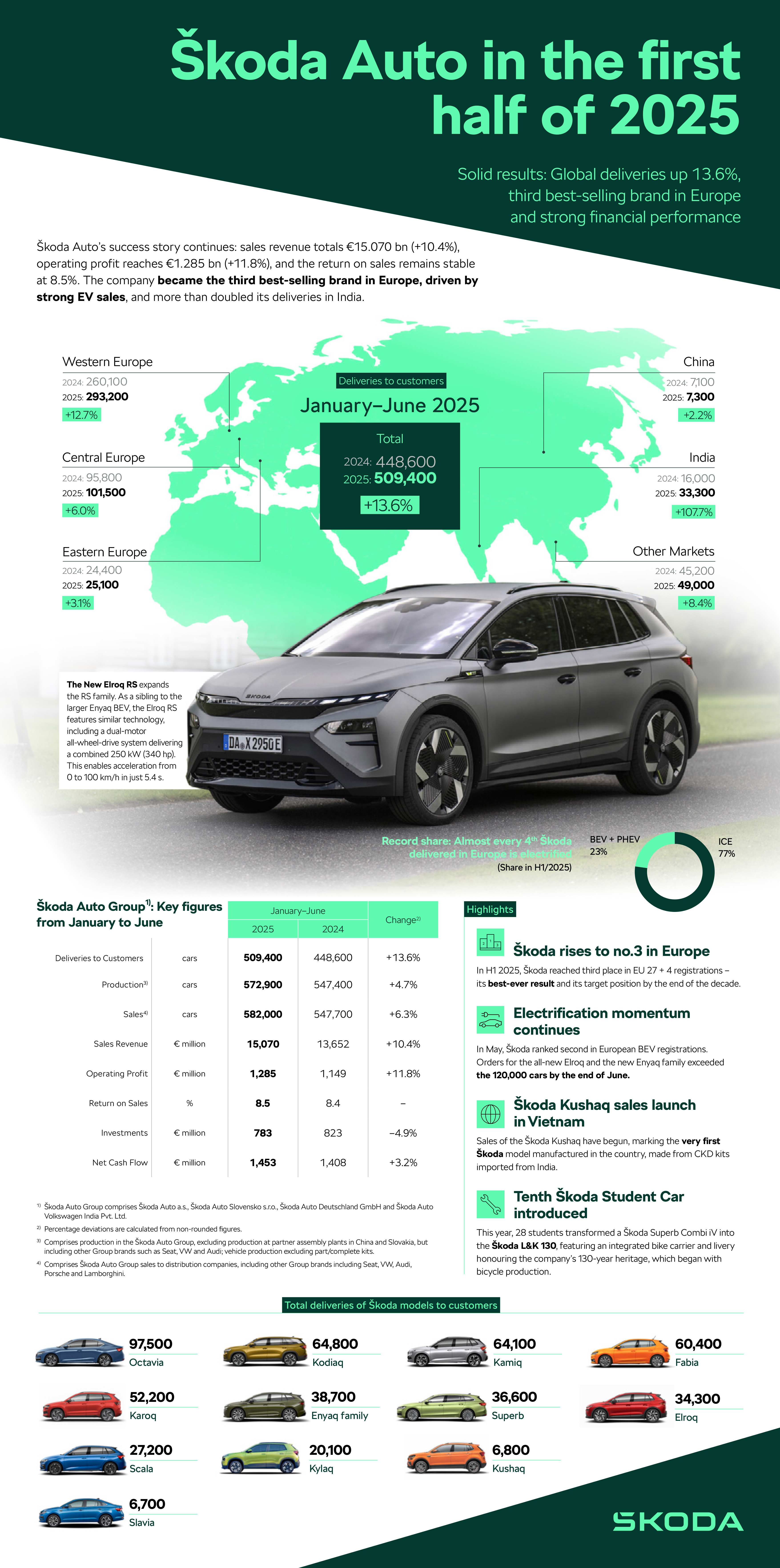

Robust demand: Škoda delivers 509,400 automobiles to prospects worldwide within the first six months of 2025 (+13.6%), turning into the third best-selling automotive model in Europe

Within the first half of 2025, Škoda Auto delivered 509,400 automobiles to prospects worldwide, representing year-on-year development of 13.6%. The robust gross sales are additionally mirrored within the firm’s monetary outcomes: income rose to €15.070 bn (+10.4%), working revenue reached €1.285 bn (+11.8%) and internet money circulate stood at €1.453 bn (+3.2%). The return on gross sales remained sturdy at 8.5% (8.4%). Škoda additionally reached a historic milestone by turning into the third best-selling automotive model in Europe (EU-27 plus the UK, Switzerland, Norway and Iceland). The Czech producer goals to safe a everlasting place among the many prime three manufacturers in Europe by the top of the last decade. On the European market, Škoda delivered 409,100 automobiles to prospects (+10.5%), considerably outperforming the general market. Robust demand for electrical and plug-in-hybrid fashions performed a key position on this success. In Europe, Škoda equipped prospects with 72,000 electrical automobiles and 21,400 plug-in hybrids, collectively accounting for 22.8% of deliveries. Škoda Auto additionally considerably strengthened its presence in Asia, delivering 33,300 automobiles to prospects in India. This achievement set a brand new document for the model in its twenty fifth yr on the subcontinent, marking year-on-year development of 107.7%. In Vietnam, gross sales started of the primary domestically produced Škoda mannequin – the Kushaq SUV.

“Škoda Auto is prospering, delivering strong monetary outcomes for the primary half of 2025 regardless of vital challenges throughout our business. As soon as once more, we now have achieved development throughout our core KPIs and demonstrated that we’re some of the worthwhile automotive manufacturers within the quantity section. These improbable outcomes are a testomony to a resilient enterprise mannequin. It’s notable that our success within the first six months has been unfold throughout powertrains, confirming we’re on the best course by providing freedom of alternative on this period of transition. And our order numbers show, that our EV technique can also be on monitor: Greater than 120,000 orders for our all-electric new Enyaq and Elroq fashions have been made by finish of June. That is how we’ve risen to change into the third best-selling automotive model in Europe from tenth place just some years in the past, as we develop European deliveries sooner than the general business. I’m deeply grateful for the optimistic response from prospects and to our suppliers and seller companions for his or her essential contributions. Škodians are performing on the prime of their league. We go into the second half of the yr in peak type whereas at all times remaining centered and vigilant.”

Klaus Zellmer, CEO of Skoda Auto

“Our key monetary indicators stay very strong as we construct on 2024 – one of the best monetary yr in our historical past. The expansion in working revenue and persistently excessive return on gross sales mirror disciplined price administration mixed with robust buyer demand, putting us among the many main quantity manufacturers. The Subsequent Degree Effectivity+ programme is already delivering tangible outcomes, notably by optimising our price construction and manufacturing processes. Trying forward, synergies inside the Model Group Core proceed to leverage vital economies of scale. We’re additionally taking proactive steps to future-proof our enterprise by enhancing our information administration capabilities, laying the inspiration for expanded AI integration and better operational effectivity. These strong outcomes and our sturdy enterprise mannequin permit us to navigate the upcoming challenges of this transformative interval from a place of energy.”

Holger Peters, Škoda Auto Board Member for Finance, IT, and Authorized Affairs

“By introducing the RS sports activities variations of the brand new Enyaq and Elroq within the first half of 2025, we’re additional enhancing our model’s emotional enchantment and increasing our vary of all-electric automobiles in key markets. These fashions are cornerstones of our electrification technique, which is progressing quickly throughout Europe. Total, we now have achieved document market shares in a number of international locations, together with Germany, Austria, Sweden and France. Our internationalisation technique can also be gathering tempo – in Türkiye, we achieved our highest ever variety of deliveries to prospects. In India, the Kylaq is having fun with distinctive success, with gross sales up by nearly 108% to an all time excessive. One other milestone is the launch of the Kushaq in Vietnam, produced on the new native plant in partnership with the Thanh Cong Group.”

Martin Jahn, Škoda Auto Board Member for Gross sales and Advertising

Škoda Auto celebrates a hundred and thirtieth anniversary with document leads to Europe and past

Within the first half of 2025, Škoda Auto achieved strong outcomes globally, delivering 509,400 automobiles to prospects – a year-on-year improve of 13.6%. This development was pushed by rising gross sales in key markets throughout Europe and India, in addition to by Škoda’s broadest and most superior mannequin vary thus far, providing all main powertrains.

For the primary time in its 130-year historical past, Škoda turned the third best-selling model in Europe (EU-27 plus the UK, Switzerland, Norway and Iceland). Deliveries on this area reached 409,100 automobiles, up 10.5% on the identical interval final yr. This consists of Škoda’s largest single market, Germany, the place 100,700 automobiles have been delivered – a ten.5% year-on-year improve. Different main beneficial properties have been posted in the UK (43,800 automobiles; +16.5%), Spain (21,100 automobiles; +20.3%), Austria (15,200 automobiles; +25.7%), Sweden (8,500 automobiles; +54.0%) and France (24,400 automobiles; +13.5%). The Czech Republic and Denmark additionally made vital contributions to this success.

This development in deliveries meant that the model outperformed the general EU market, reaching robust market shares in a number of Western European international locations, together with Austria (10.64%), Denmark (10.21%), and Germany (7.18%).

Sturdy monetary outcomes: income and revenue development with a strong return

Within the first half of 2025, Škoda Auto reported revenues of €15.07 bn (+10.4%), with working revenue rising to €1.285 bn (+11.8%) and internet money circulate reaching €1.453 bn, a rise of three.2% year-on-year. The return on gross sales remained robust at 8.5% (2024: 8.4%). These outcomes have been pushed not solely by robust buyer demand but additionally by strict price self-discipline. The continual income development lately demonstrates the effectiveness of Škoda Auto’s technique and enterprise mannequin, even below difficult market circumstances.

Electrification accelerates quickly: new Enyaq and Elroq fashions prime the rankings

Škoda’s electrical fashions stay standard, with the corporate delivering 72,000 electrical automobiles and 21,400 plug-in hybrids to prospects in Europe. Collectively, these accounted for 22.8% of deliveries (H1 2024: 9.4%). Almost one in 4 Škoda automobiles bought in Europe now options an electrified powertrain. This efficiency was pushed by robust demand for the all-electric Enyaq and Elroq fashions, in addition to the latest-generation Very good and Kodiaq plug-in hybrids – each providing an electrical vary of over 100 km – highlighting Škoda’s profitable transformation in direction of sustainable mobility.

The Elroq loved appreciable success within the first half of the yr, taking the highest spots amongst electrical automobiles within the European market in April, Might and June. In each the Czech Republic and Denmark, it was the best-selling BEV throughout the first six months of 2025. The brand new Enyaq additionally continues to carry out strongly, rating second in Switzerland’s BEV section over the identical interval.

Total, the Octavia stays Škoda’s hottest mannequin, with 97,500 deliveries to prospects, adopted by the Kodiaq and Kamiq.

Worldwide milestones: development in India and the launch of the Kushaq in Vietnam

Škoda achieved its best-ever end in India, delivering round 33,300 automobiles – a year-on-year improve of 107.7%. The newly launched Kylaq made a major contribution to this success, with over 20,000 prospects taking supply by the top of June. These outcomes are bolstering Škoda’s place among the many seven main automotive manufacturers in India.

In March 2025, Škoda Auto Volkswagen India Personal Restricted (ŠAVWIPL) surpassed the milestone of 500,000 engines produced at its Pune plant.

In Vietnam, gross sales of the Kushaq – manufactured domestically in partnership with the Thanh Cong Group – have begun. Škoda is leveraging synergies with India by importing utterly knocked-down (CKD) kits for ultimate meeting. Alongside the Kushaq, Škoda’s Vietnamese line-up already consists of the Karoq and Kodiaq SUVs, that are imported from Europe. Within the coming months, the vary shall be expanded to incorporate the Slavia saloon, which will even be assembled domestically from CKD kits manufactured in India.

Skoda Auto Group1) – Comparability of key figures, H1 2025 vs H1 20242)

| H1 2025 | H1 2024 | Change (%) | ||

| Deliveries to prospects | automobiles | 509,400 | 448,600 | +13.6 |

| Manufacturing3) | automobiles | 572,900 | 547,400 | +4.7 |

| Gross sales4) | automobiles | 582,000 | 547,700 | +6.3 |

| Gross sales income | € million | 15,070 | 13,652 | +10.4 |

| Working revenue | € million | 1,285 | 1,149 | +11.8 |

| Return on gross sales | % | 8.5 | 8.4 | – |

| Investments | € million | 783 | 823 | -4.9 |

| Web money circulate | € million | 1,453 | 1,408 | +3.2 |

1) Škoda Auto Group Contains Škoda Auto AS, Škoda Auto Slovakia sro, Škoda Auto Deutschland GmbH, Škoda Auto Volkswagen India PVT. Ltd.

2) Proportion deviations are calculated from non-rounded figures.

3) Contains manufacturing within the Škoda Auto Group, excluding manufacturing at associate meeting crops in China and Slovakia, however together with different Group manufacturers equivalent to SEAT, VW and Audi; automobile manufacturing excluding half/full kits.

4) Contains Škoda Auto Group gross sales to distribution firms, together with different Group manufacturers together with Seat, VW, Audi, Porsche and Lamborghini.

World automobile deliveries in H1 2025 by chosen gross sales areas:

| Gross sales area | H1 2025 | H1 2024 | Change (%) | ||

| Western Europe | 293,200 | 260,100 | +12.7 | ||

| Germany (largest market) | 100,700 | 91,100 | +10.5 | ||

| Central Europe | 101,500 | 95,800 | +6.0 | ||

| Czech Republic | 45,800 | 41,300 | +10.9 | ||

| Japanese Europe | 25,100 | 24,400 | +3.1 | ||

| China | 7,300 | 7,100 | +2.2 | ||

| India | 33,300 | 16,000 | +107.7 | ||

| Remainder of the World | 49,000 | 45,200 | +8.4 | ||

| Complete worldwide | 509,400 | 448,600 | +13.6 |

Škoda automobile deliveries to prospects in H1 2025

(in items, rounded, listed by mannequin; proportion change in comparison with H1 2024):

| Mannequin | H1 2025 | Change (%) |

| Skoda Octavia | 97,500 | ?19.6 |

| Skoda Kodiaq | 64,800 | +26.7 |

| Disgrace kamiq | 64,100 | +4.9 |

| Skoda Fabia | 60,400 | +6.4 |

| Skoda Karoq | 52,200 | ?1.7 |

| Skoda Enyaq | 38,700 | +31.3 |

| Skoda Very good | 36,600 | +19.7 |

| Injury to ELROQ | 34,300 | ? |

| Skoda Scala | 27,200 | ?6.4 |

| Skoda Kylaq | 20,100 | ? |

| Škoda kushaq | 6,800 | ?18.3 |

| Skoda Slavia | 6.700 | ?5.0 |

SOURCE: Škoda