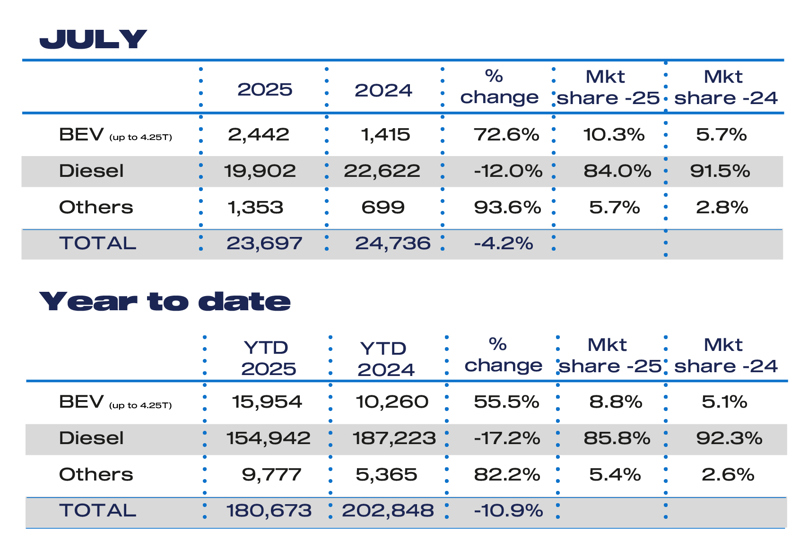

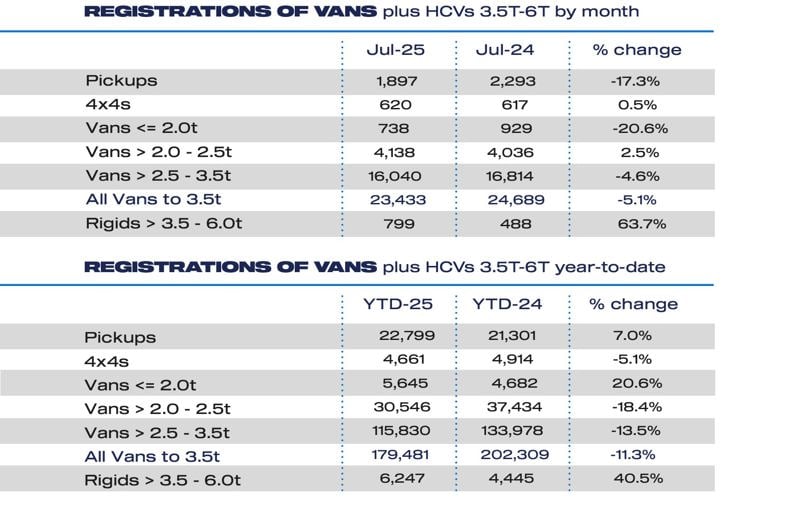

The brand new gentle industrial automobile (LCV) market shrank by 5.1% in July, with 24,433 vans, pickups, 4x4s and taxis registered – marking the sector’s eighth consecutive month of decline, in response to the Society of Motor Producers and Merchants (SMMT).

Knowledge signifies final month was the weakest July efficiency since 2022, as persistent financial uncertainty and low enterprise confidence proceed to suppress fleet funding. Most automobile segments recorded a drop in registrations, with the sharpest fall seen within the smallest vans (below 2 tonnes), down 20.6% to only 738 items.

Deliveries of enormous vans (2.5–3.5 tonnes), the spine of many industrial fleets, additionally dipped by 4.6%, totalling 16,040 registrations. Pickups fell for the third consecutive month – down 17.3% to 1,897 items – following tax rule modifications in April that reclassified double-cabs for benefit-in-kind and capital allowance functions.

There have been small brilliant spots with mid-sized vans (2.0–2.5 tonnes) rising 2.5% to 4,138 items and 4×4 registrations up by 0.5% to 620 items

Regardless of the broader market decline, battery electrical vans (BEVs) posted one other sturdy month, with registrations up 72.6% to 2,442 items, extending a streak of eight consecutive months of progress. Nevertheless, BEVs nonetheless signify simply 8.8% of the LCV market to date in 2025 – properly in need of the 16% zero-emission automobile (ZEV) mandate goal set by the federal government for this 12 months.

Even so, producers are responding to demand with greater than 40 BEV fashions now available on the market, providing a wide range of payloads and value factors. However business leaders warn that infrastructure and coverage lag behind.

Mike Hawes, SMMT chief government, stated: “Eight months of LCV market decline underlines the continuing financial pressures going through companies, but the sector stays steadfast in its dedication to decarbonise.

“Producers proceed to put money into delivering a various vary of zero-emission vans to swimsuit each use case, and it’s encouraging to see uptake rising – however to fulfill mandated targets, it should develop quicker. Accelerating infrastructure rollout, streamlining planning processes and offering focused help for fleet operators are important to drive progress and maintain the UK on the forefront of street transport decarbonisation.”

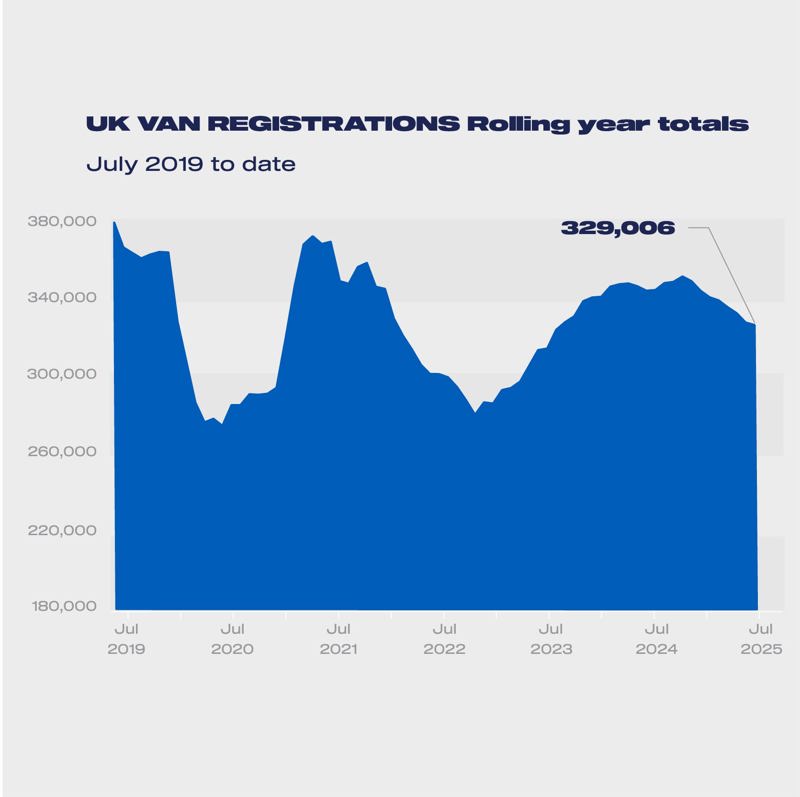

The SMMT has revised its full-year 2025 forecast, now predicting the market will contract by greater than 30,000 items – an 8.7% drop to 321,000 registrations. The BEV market share forecast has additionally been downgraded from 9.4% to eight.6% for 2025, with solely a marginal rise to 13.7% anticipated in 2026 – nonetheless far under the 24% ZEV mandate for that 12 months.

“July’s figures have seen the brand new gentle industrial automobile market decline for the eighth consecutive month, reflecting ongoing strain on demand and financial uncertainty” stated Sue Robinson, chief government of the Nationwide Franchised Sellers Affiliation (NFDA), which represents franchised automobile and industrial automobile retailers within the UK.

“Though this decline just isn’t the worst seen this 12 months, it’s nonetheless of main concern that the sunshine industrial automobile gross sales is seen as a barometer of the energy of the economic system and 12 months to this point LCV registrations have decline at -11.3%.”