Roland Berger Automotive Disruption Radar: China in pole place, dominating on electrical automobile (EV) choice (95%), EV market share (25%) and growth pace

The worldwide automotive trade has reached an inflection level. As the brand new version of Roland Berger’s Automotive Disruption Radar (ADR 14) exhibits, China is more and more pulling into the lead on know-how, putting high among the many international locations surveyed. Against this, European nations and particularly the US are coming below strain. Germany held its place within the main group, rating seventh, primarily because of advances in autonomous driving, fixed patent exercise and its export-oriented OEMs. The research, for which Roland Berger consultants analyzed the efficiency of twenty-two automotive nations throughout 26 trade indicators and surveyed greater than 22,000 automotive homeowners, additionally reveals that regional ecosystems are more and more diverging: There are quickly rising variations between markets on elements like know-how requirements, regulation and buyer preferences – particularly between China and the remainder of the world. Although full decoupling is unlikely, this growth means automakers should undertake completely different approaches for various goal areas.

“The automotive trade’s transformation is in full swing, however it isn’t taking place on the similar tempo worldwide,” says Wolfgang Bernhart, Associate at Roland Berger. “China is quickly pulling away from different areas and is now dominant in all key areas of the automotive trade – from EV market share to charging infrastructure to AI-powered driver help programs. Not solely that: Chinese language automakers’ growth cycles are 24 to 40 months lengthy, whereas European OEMs take 48 to 60 months to develop a brand new automobile. Europe is falling behind.”

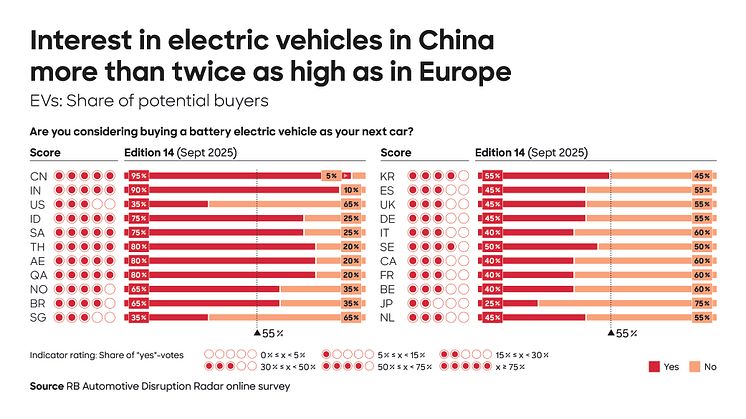

EV market share in China is greater than twice as excessive as in Europe

China has due to this fact pulled properly forward of the pack within the ADR 14 rating. With high scores in know-how and infrastructure indicators, the nation has bolstered its main place within the now key areas of electrified and automatic mobility. Customers are additionally very within the newest electrical autos – 95% specific a willingness to purchase an EV as their subsequent automobile – and OEMs are providing intensive EV portfolios and a well-developed charging infrastructure. The share of electrical autos in new automotive gross sales in China has thus risen from 22% to 25% because the final version of the ADR, whereas Europe’s EV share has stagnated at 12%. In Germany, the share of people who find themselves contemplating shopping for a battery electrical automobile as their subsequent automotive has fallen from 55% in 2021 (ADR 9) to 45% on this version of the ADR.

Making up the remainder of the main pack behind China are South Korea, the Netherlands, Norway, Sweden and Singapore. Germany follows shut behind in seventh place, scoring factors regardless of declining EV gross sales figures because of its environment friendly and fast type-approval processes for autonomous driving capabilities, continued sturdy patent exercise and a globally famend, export-oriented OEM sector. Nevertheless, client curiosity in shared mobility within the nation has declined, and there stays a notable reluctance amongst each shoppers and suppliers to interact with modern choices akin to digital gross sales channels for automobile purchases.

The necessary US automotive market slipped to 14th place, partly attributable to declining client curiosity in new applied sciences and ideas akin to shared mobility. That is coupled with the nation’s rising isolation attributable to political uncertainty, alongside slowing innovation momentum within the mobility sector. As well as, extra individuals are transferring again in the direction of non-public automobile possession within the US, a pattern that can be evident in different mature markets akin to Germany, Japan and China.

Regional differentiation poses a problem for OEMs

On this version of the ADR, the Roland Berger consultants took a selected have a look at the rising divergence between automotive markets globally: “We’re seeing completely different areas more and more taking completely different paths, significantly by way of software program, requirements and growth pace, but in addition in the case of buyer expectations,” says Stefan Riederle, Associate at Roland Berger. Though he considers an entire decoupling of auto architectures impossible, not least for industrial causes, Riederle recommends that automakers ought to hold a detailed eye on developments and combine them of their plans: “OEMs’ future will rely upon their capacity to mix strategic alliances, software program experience and adaptation to the best way markets are diverging. Going ahead, automakers might want to work with not less than two programs: one for China and one for the remainder of the world.”

Extra info: www.automotive-disruption-radar.com

SOURCE: Roland Berger