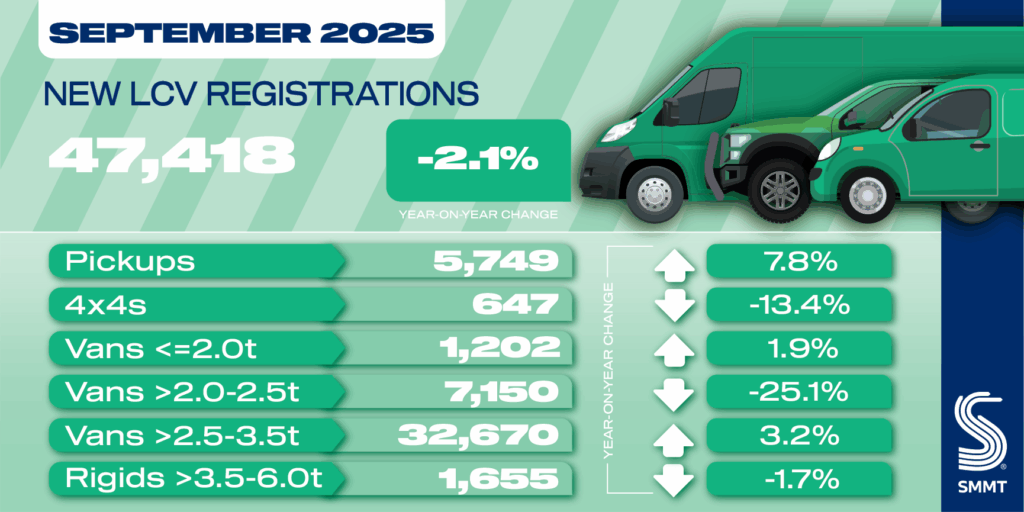

UK deliveries of recent mild business automobiles (LCVs) dipped by -2.1% in ‘new numberplate’ September with 47,418 vans, pickups and 4x4s registered, in keeping with the newest figures printed at present by the Society of Motor Producers and Merchants (SMMT)

UK deliveries of recent mild business automobiles (LCVs) dipped by -2.1% in ‘new numberplate’ September with 47,418 vans, pickups and 4x4s registered, in keeping with the newest figures printed at present by the Society of Motor Producers and Merchants (SMMT).

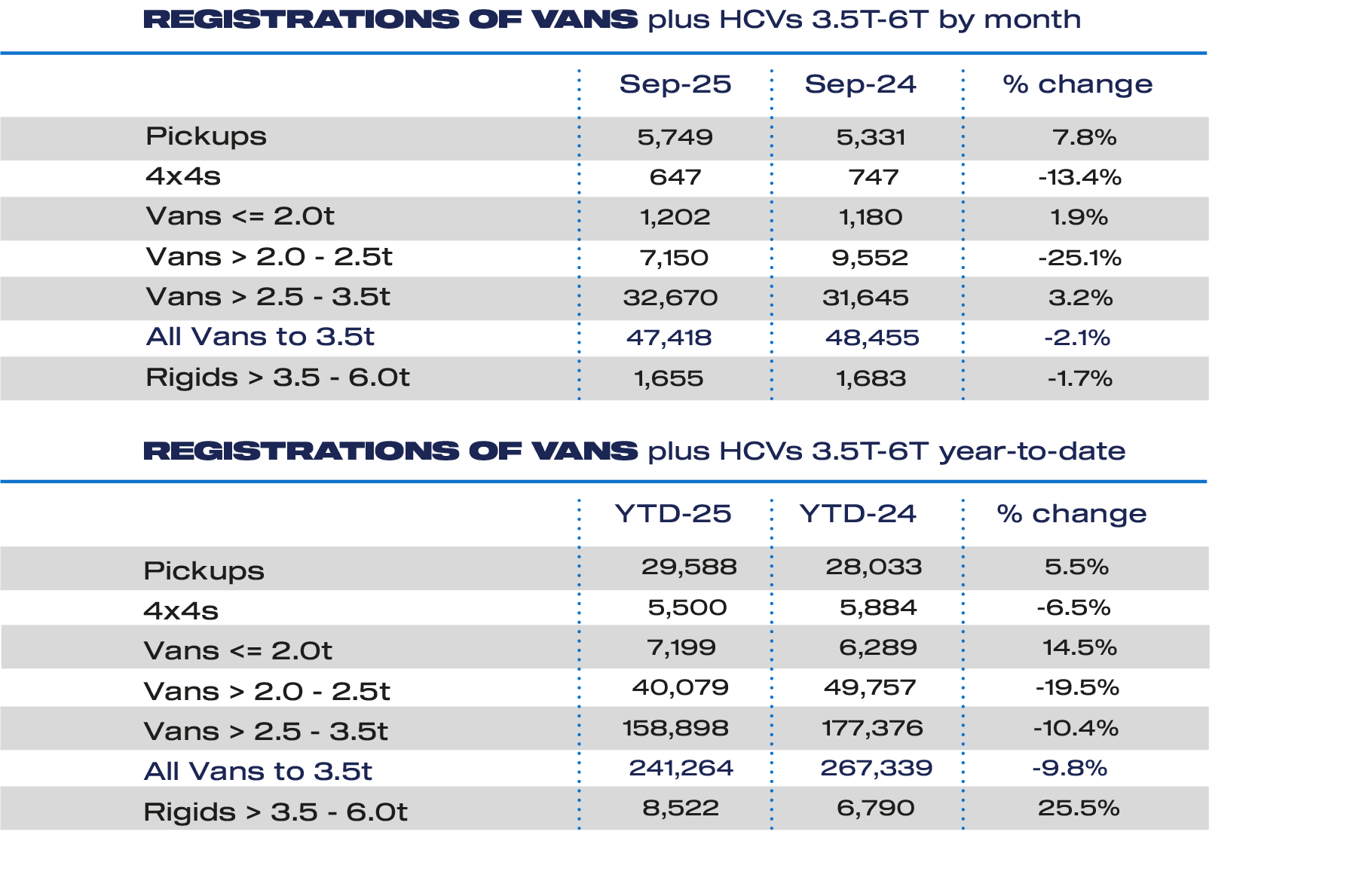

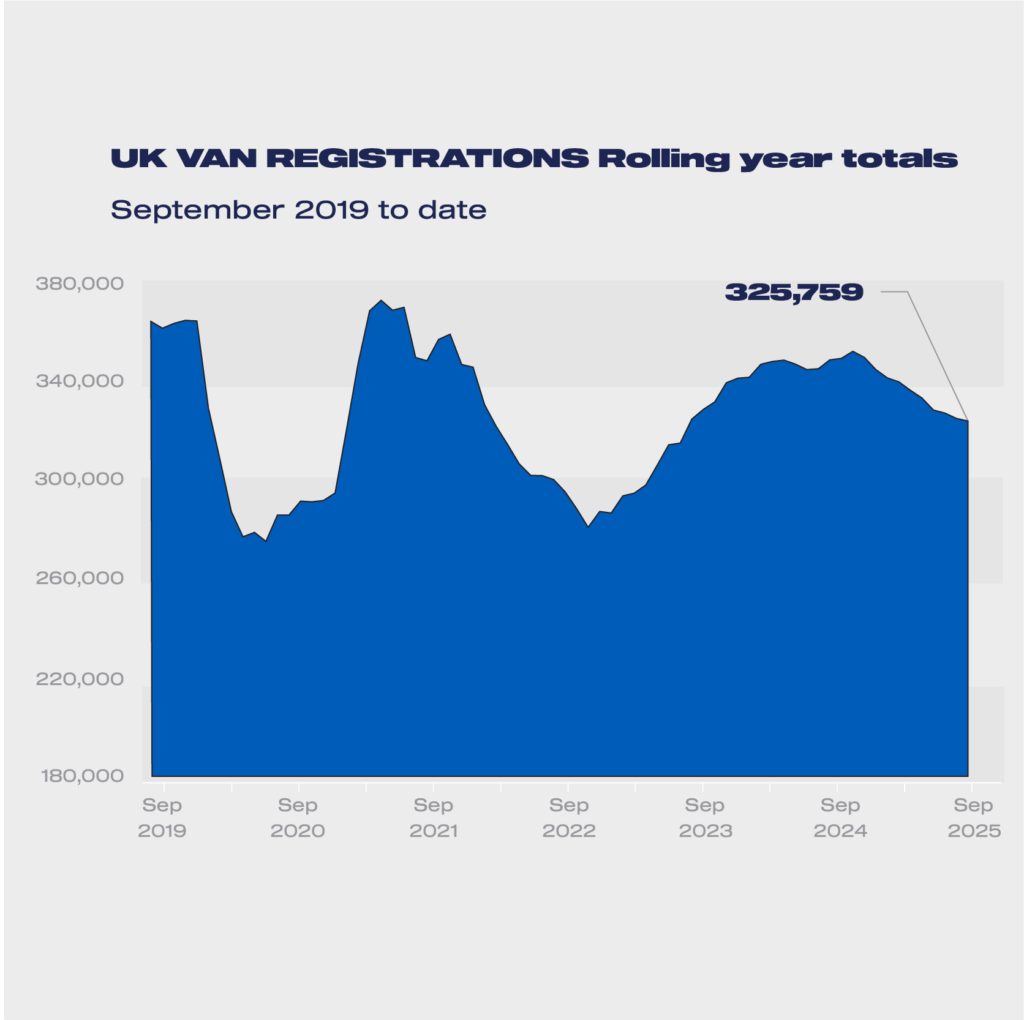

The modest drop continues 2025’s downward development, with registrations down -9.8% yr thus far, reflecting a troublesome financial setting and weak enterprise confidence. The efficiency, nevertheless, is the smallest decline this yr and nonetheless stays above pre-pandemic ranges, offering a key constructive in one of many market’s busiest months – as van producers proceed to speculate closely to carry cutting-edge, zero emission fashions to market.1

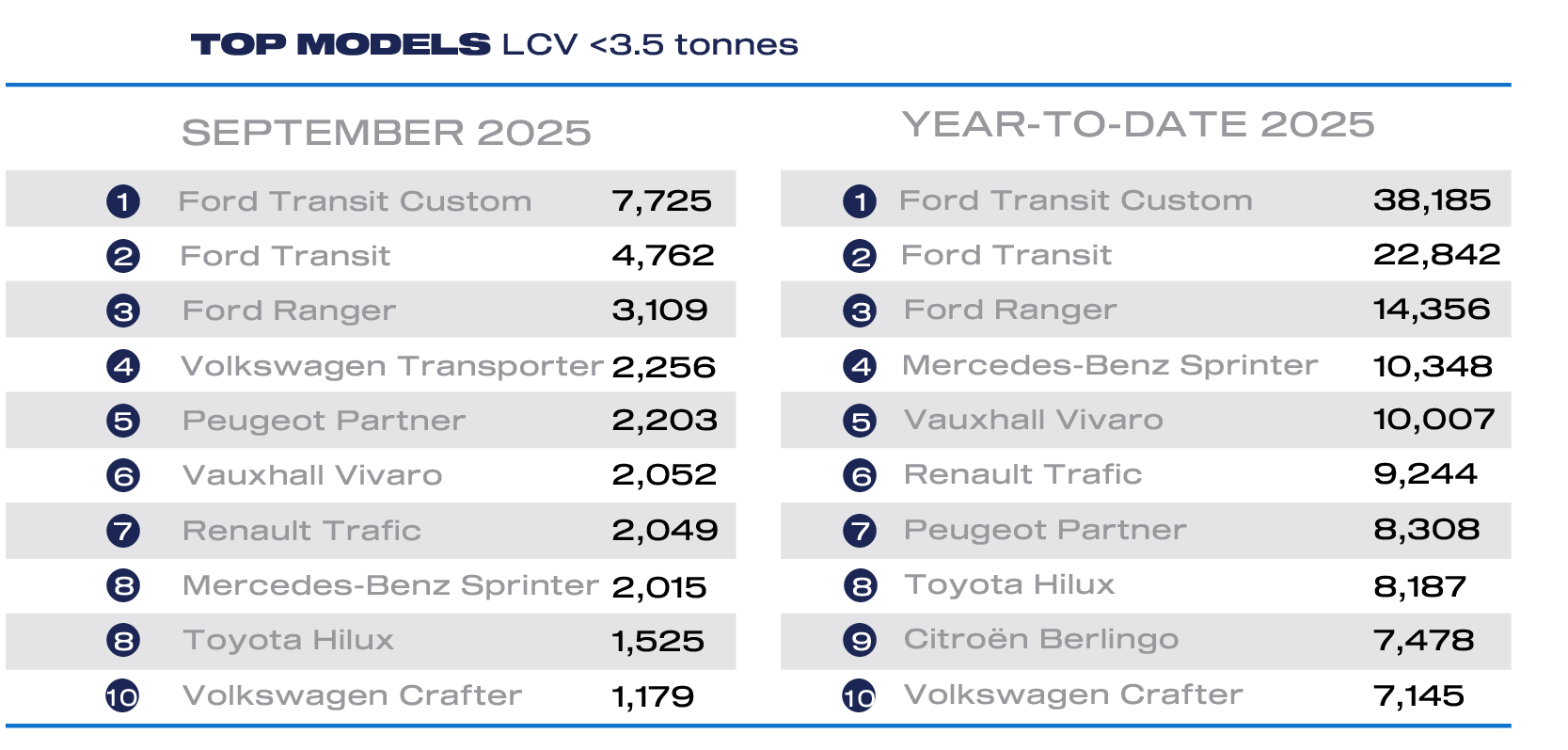

Phase efficiency was blended, with the general decline softened by an increase in deliveries of the most important vans, up 3.2% to 32,670 models – the most important section by quantity, representing nearly seven in 10 (68.9%) registrations. Demand for brand new pickups and the smallest sized vans additionally grew, up 7.8% and 1.9% to five,749 and 1,202 models respectively, as earlier new pickup orders had been delivered earlier than authorities’s new fiscal measures on double-cabs are utilized to orders positioned after April. Medium-sized van uptake fell, by -25.1% to 7,150 models, whereas 4×4 uptake declined by -13.4% to 647 models.

New electrical van (EV) registrations continued their robust upward trajectory, rising 41.1% year-on-year to 4,262 models – probably the most ever recorded in a single month, reaching a market share of 8.9%.2 Yr-to-date BEV volumes now stand at 22,118 models, up 55.9% on 2024 to characterize 9.1% of all new registrations. It’s spectacular development in a troublesome yr for the general market, however nonetheless properly under the 16% share mandated for 2025. Producers are driving that development, investing closely in electrical van fashions with greater than 40 choices now out there to fleet operators.

The extension of the Plug-in Van Grant and the latest Depot Charging Scheme will assist operators swap, however reaching mandated ambition is dependent upon boosting operator confidence and guaranteeing entry to acceptable charging infrastructure. The swap should be accessible for all new patrons, together with these requiring van-suitable charging infrastructure at public, on-street and in a single day places. Given depots might face grid connection waits of as much as 15 years, pressing precedence for planning approval is required – like that afforded knowledge centres and wind farms – so that companies can plan for a clean and well timed transition of their fleet operations.3

Mike Hawes, SMMT Chief Government

September is without doubt one of the busiest months for the brand new van market so a slight dip in volumes in contrast with earlier robust years is disappointing however unsurprising. The expansion in electrical van uptake is vastly encouraging, however the market is below strain to ship the funding vital for decarbonisation. Producers are delivering an enormous selection of fashions to swimsuit all companies – now we want higher devoted infrastructure and persevering with incentives to drive the swap.

1LCV registrations, September 2019: 41,216

2SMMT’s BEV LCV registration knowledge displays the Car Emissions Buying and selling Scheme, during which BEVs weighing >3.5-4.25t contribute in the direction of every producer’s goal, along with these weighing ?3.5t

3DESNZ, 15 April 2025

SOURCE: SMMT