When was the final time that you simply wanted a journey on the final minute? For those who didn’t wish to inconvenience a member of the family or good friend, you might have known as a taxi or scheduled a journey by a limousine firm. There’s a new possibility getting into the marketplace for folks on this predicament, although. It’s known as “Trip Sharing,” and although the idea might sound technologically savvy, it presents a number of considerations to drivers and passengers that use the related apps.

The Rise of Trip Sharing Apps

Within the previous days, you used to have to rent a limo or a cab if you happen to wanted a journey on brief discover. These days, although, there are a number of apps that present Trip Sharing providers. It’s a approach for drivers to earn some additional money offering rides at any time when they’ll, utilizing their private automobile.

Utilizing certainly one of these apps as simple as putting in Uber, Lyft, or Sidecar and requesting a journey. A verified driver will decide you up and take you to your vacation spot. You possibly can even pay the driving force, price them, and tip them by the app typically.

The Auto Insurance coverage Conundrum

For probably the most half, a journey that’s taken (or given) with a ridesharing app will be damaged down into three components. The primary is when the driving force is on the lookout for work, however doesn’t but have a shopper. The second is when the driving force is on their option to a ready shopper. And the third (as you would in all probability guess) is when the driving force is transporting the shopper.

The problem that’s cropping up everywhere in the nation is that this: What occurs when a driver is in an accident? Trip Sharing corporations declare to offer extra legal responsibility insurance coverage for his or her drivers, however think about this situation: in California, an Uber driver

hit and killed a six yr previous woman

on his option to decide up a buyer. The driving force’s private auto insurance coverage coverage says that Uber ought to be accountable as a result of the app was lively, however Uber is refusing legal responsibility as a result of there was no passenger within the automotive on the time of the accident. And that’s only one instance of a case – there are lots of extra instances like this occurring all through the nation, and drivers are studying the exhausting approach that the insurance coverage state of affairs in these instances may be very sophisticated.

Insurance coverage Loopholes

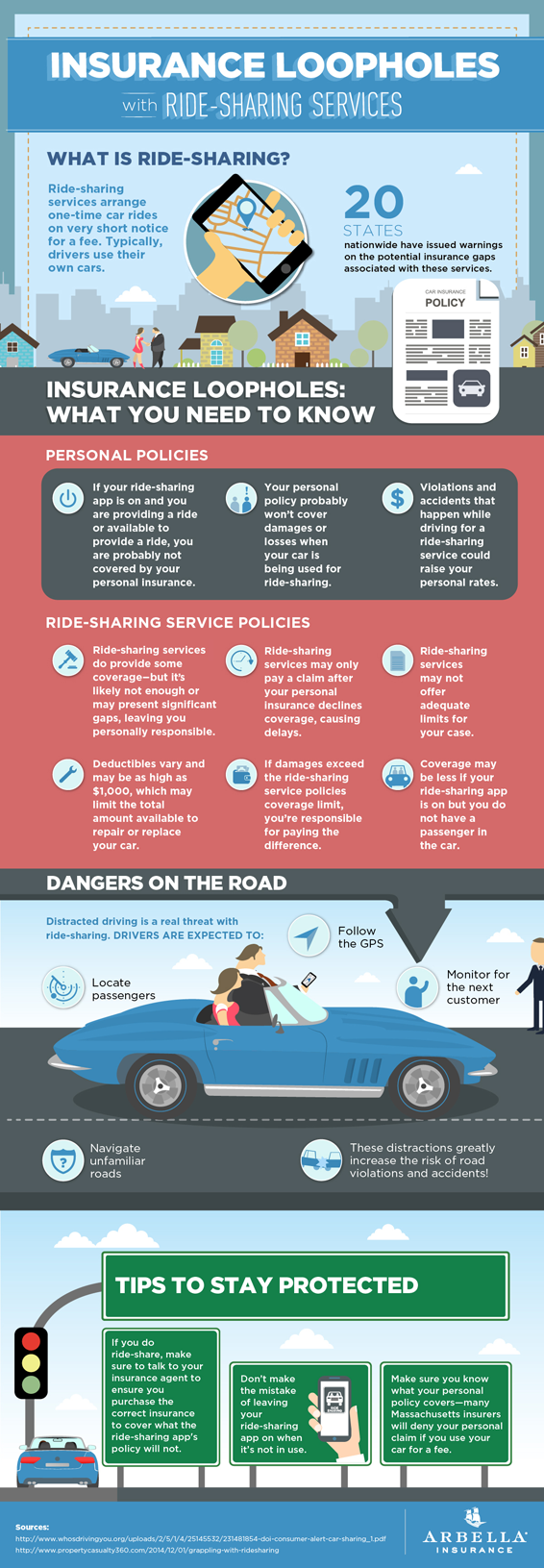

An infographic

supplied by our pals at Arbella Insurance coverage reveals only a few of the insurance coverage loopholes that you could be encounter if you happen to drive for a ridesharing firm:

In case you are working a journey sharing software, your private auto insurance coverage coverage might not cowl you for damages or losses.

Violations and accidents that happen if you find yourself working a journey sharing app may nonetheless trigger a rise in your private insurance coverage charges.

Trip Sharing providers might give you further legal responsibility insurance coverage, however their protection might have vital gaps. Deductibles on their insurance coverage might also be as excessive as $1,000. And in the event that they don’t present sufficient protection, you would be liable for the distinction!

So earlier than you begin to rent out your automotive to make a little bit bit of additional money, it’s best to rigorously think about the dangers that you would be enterprise. In case you are nonetheless inquisitive about collaborating within the Trip Sharing phenomenon, just be sure you name your Vargas and Vargas Insurance coverage agent at

617-298-0655

earlier than you even take into consideration selecting up your first buyer. As

auto insurance coverage consultants

we can assist you make sure that you’re coated in all the conditions that you simply encounter on the highway – even in case you have a shopper in tow.

*Edit

: There’s now protection obtainable for drivers whereas they’re logged in to journey sharing apps however shouldn’t have an lively passenger. Learn extra on Insurance coverage Journal right here:

ISO Introduces Endorsements to Tackle Ridesharing Coverage Gaps