China’s luxurious market is heading into 2026 in a interval of cautious stabilisation following years of aggressive enlargement and a pointy post-pandemic slowdown. Progress has shifted away from volume-driven methods towards tighter pricing self-discipline, selective consumption and extra deliberate model engagement. Fairly than opening shops at velocity, manufacturers are specializing in deeper penetration into rising cities, sharper segmentation and longer-term model fairness. Trade observers notice that whereas the market has not returned to pre-pandemic progress charges, it’s exhibiting early indicators of restoration. Analysts argue that the tempo and sustainability of this rebound will rely closely on client confidence and broader macroeconomic stability, reasonably than stimulus-led acceleration.

Give attention to Rising Cities

Luxurious manufacturers are more and more reallocating assets towards China’s so-called “rising” or lower-tier cities, the place wealth accumulation continues at the same time as top-tier consumption softens. Luxurious manufacturers have expanded retailer networks in tier-two and choose tier-three cities comparable to Changsha, Wuhan, Chengdu and Xi’an, prioritising fewer however larger-format shops that anchor premium purchasing malls reasonably than blanket enlargement. A latest business survey discovered that luxurious manufacturers opened 244 shops in China, with 169 in non-first-tier cities and 75 in first-tier markets, underscoring a shift towards broader geographic protection.

Emergent markets comparable to Wuhan, Chengdu, Xi’an and Hangzhou are more and more necessary nodes in China’s luxurious community, with luxurious shops making up a rising share of whole retailer counts exterior Beijing and Shanghai. In Could, Miu Miu opened its first flagship retailer (spanning round 5,200 sq. toes and three tales) in Wuhan, positioned inside the newly opened SKP Division Retailer. That is additionally seen with Coach which opened a flagship in Wuhan and Moncler which opened new shops in Nanjing, Jinan and Hefei demonstrating funding in non-tier-one markets and enlargement exterior the very prime cities.

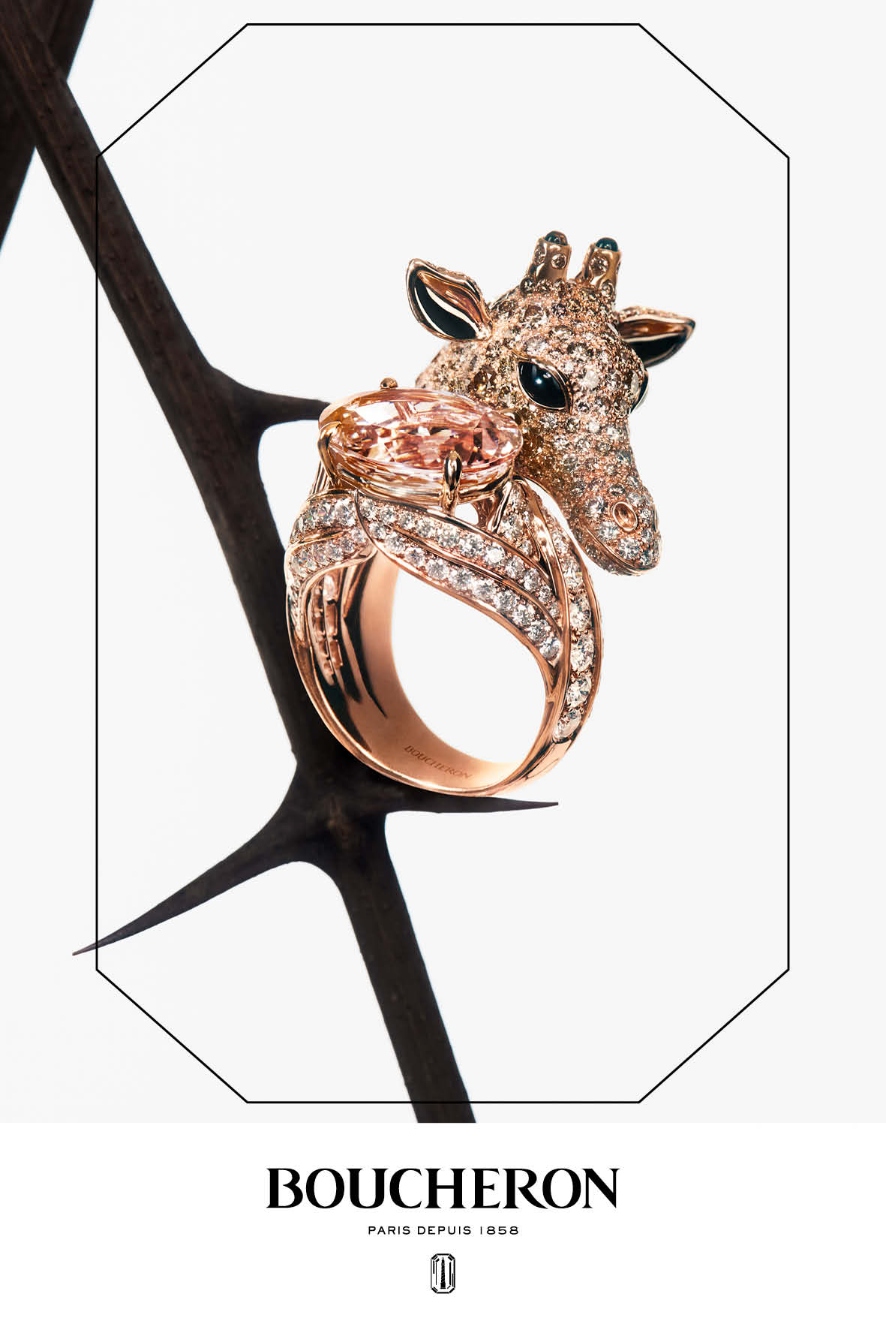

Fairly than accelerating retailer openings in Beijing and Shanghai, manufacturers are selectively deepening their presence in tier-two cities the place consumption stays resilient and competitors is much less saturated. This might probably see a pattern of luxurious jewelry Maisons like Cartier or Van Cleef & Arpels presenting excessive jewelry occasions in third-tier cities like Hangzhou or Suzhou as Richemont reported general progress in luxurious jewelry demand in Larger China

Valentino’s Haute Couture 2019 in Beijing

There’s Luxurious in Shortage

Fairly than pulling again totally, Chinese language shoppers have gotten extra selective. Spending is more and more concentrated in classes and types that ship a mix of emotional resonance, cultural relevance and tangible worth. This shift is forcing luxurious homes to reassess product technique, pricing structure and engagement fashions, significantly as discretionary spending comes beneath stress. This selectivity helps clarify why sure segments are outperforming at the same time as general progress stays muted.

Fairly than driving short-term quantity by means of promotions or speedy rollout, manufacturers are defending pricing energy and artistic coherence to protect model fairness. For instance, Hermès continues to limit provide in China, reinforcing shortage and long-term model energy reasonably than maximising near-term income. Valentino and Bottega Veneta have leaned into distinct inventive identities — maximalism and craft-led minimalism, respectively — reasonably than chasing pattern cycles tied to fast gross sales. International luxurious teams have scaled again aggressive discounting and worth harmonisation in China, favouring tighter pricing self-discipline and fewer promotional cycles to safeguard model notion — reinforcing the concept that shortage is a defining marker of luxurious.

Understanding Market Segmentation

That is mirrored in how manufacturers adapt to “market segmentation” by shifting away from treating China as a single monolithic market and as a substitute refining segmentation by age, spending behaviour and motivation. Chanel and Dior are investing in differentiated clienteling methods, with personal salons and invitation-only occasions geared toward high-spending VICs, whereas sustaining extra managed entry-level entry for aspirational consumers.

Then, there are Prada and Loewe who’ve adjusted product mixes in China to replicate demand for expressive trend and storytelling-led collections, reasonably than relying solely on globally standardised assortments (working example being Lunar New Yr releases). This sees luxurious homes phase Chinese language demand extra finely — separating high-net-worth, investment-led shoppers from youthful or emotionally pushed consumers — reasonably than chasing quantity throughout the board.

TreinslH (Content material for Qixi Pageant from LOEWE) ??2025.08.04 ?Micro-drama Episode 1 ?Caption: Episode 1: The magpie pendant she intentionally misplaced, who picked it up? ?Embracing various inventive expressions is LOEWE’s custom. Through the Chinese language Valentine’s Day in 2025, LOEWE launched a particular Chinese language Valentine’s Day sequence and the unique drama “Quie Ding Love” to pay tribute to this conventional competition with the theme of affection. Tomorrow evening at 7 o’clock, the heartbeat will proceed. ?Screenwriter: LOEWE Luo Yiwei Chinese language cultural advisor Qin Wen? @Not Qin Wen Starring: @?Duling, @???- #ILOEWEYOU# (Half 1: The magpie keychain that she unintentionally misplaced Who picked it up? Embracing various technique of expression has at all times been one of many traits of the LOEWE model. In Qixi Pageant 2025, LOEWE launches a particular assortment to welcome the Pageant of Love. With the unique sequence “The magpie that binds the destiny of affection” to go on the deep emotions of this love-filled competition. Tonight at 7:00 p.m., the trembling emotions will return once more. Tv script: Qin Wen, LOEWE’s Chinese language cultural advisor. Starring: Chen Tuling, Chen Zeyuan ) #Chen Zeyuan #far #??? #??? #chenzheyuanchenzheyuan #ChenZheyuan ? Unique sound – KoiNK?CZY – KOILoveCZY

China Informs (Not Follows) Developments

Luxurious advertising and marketing in China has not too long ago seen an explosive progress in short-form drama content material. China’s micro-drama viewers is predicted to succeed in 696 million customers in 2025, with platforms comparable to Xiaohongshu and Tmall integrating narrative content material instantly into commerce. Fairly than relying solely on movie star endorsements, luxurious manufacturers are experimenting with authentic micro-dramas as a solution to construct emotional engagement and shorten the trail to buy. That is seen with Loewe who unveiled an authentic five-episode micro-drama dubbed “Say Sure to Love” as a part of the discharge of the 2025 Chinese language Valentine‘s Day assortment impressed by conventional Qixi legend imagery. This marks a shift towards extra frequent, story-led touchpoints that align with evolving content material consumption habits.

Moreover, home manufacturers that already perceive the nuances of the market are gaining floor as Chinese language labels like Laopu Gold and Songmont have seen speedy market share will increase, difficult European homes and drawing strategic consideration from teams like LVMH — whose leaders are more and more participating with native designers.

Gold is a Lady’s Greatest Pal

Gold jewelry has gained renewed strategic significance as Chinese language shoppers more and more view it as each a cultural image and an funding asset — significantly amid the rising worth of gold. Home manufacturers rooted in conventional craftsmanship — together with Laopu Gold and Baolan — have seen surging demand to cater to it. The momentum has drawn strategic consideration from world luxurious teams comparable to LVMH and Kering, underscoring a broader recalibration of luxurious worth in China towards materials value.

Maybe not directly (or instantly) associated to that is the analysis that exhibits that girls aged 45 to 59 have emerged as one among China’s most influential luxurious client teams, controlling an estimated RMB 10 trillion in annual spending. This demographic is understood to position precedence on long-term relevance over novelty or trend-driven consumption.

China’s luxurious market is absorbing financial stress by prioritising selective spending over quantity progress. Progress now is dependent upon alignment with home values and selective client confidence — a actuality verify that’s forcing luxurious manufacturers to rethink how briskly they develop and why shoppers ought to select them in any respect.

For extra on the newest in enterprise and luxurious business reads, click on right here.