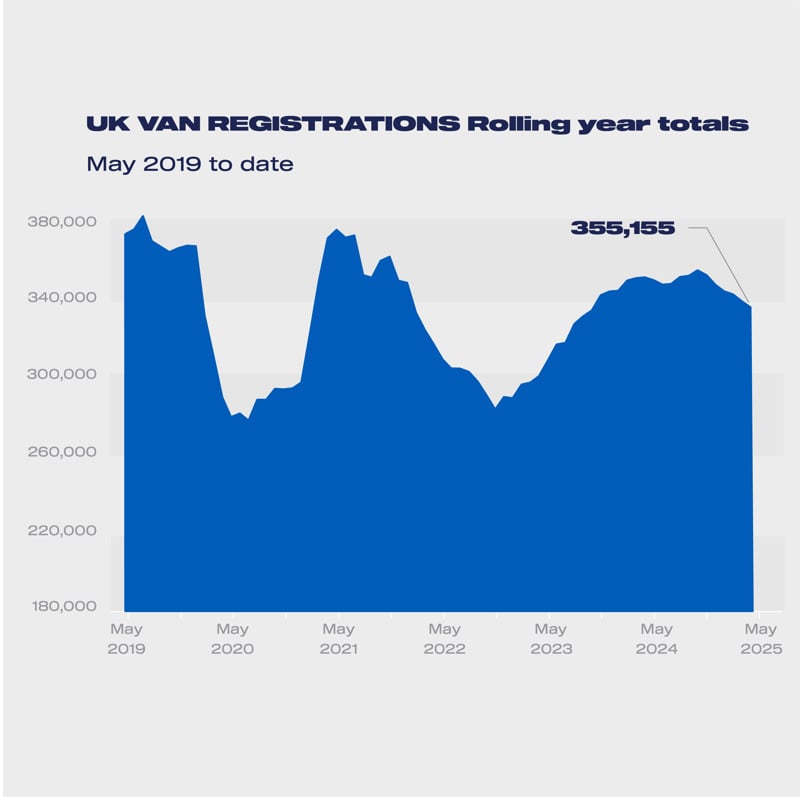

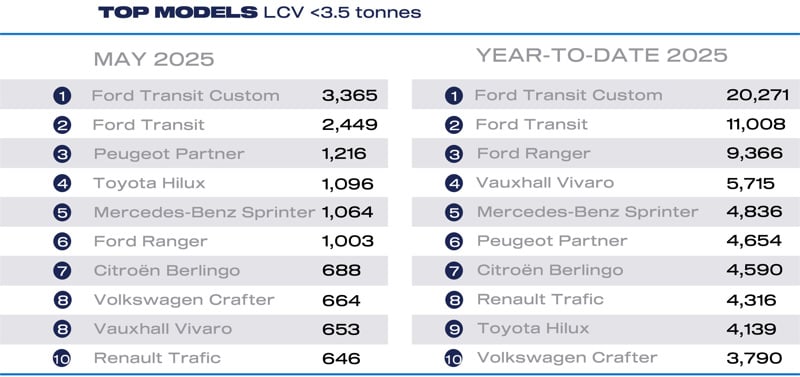

The sunshine business automobile (LCV) market shrank by -11.8% in Could, with 22,796 vans, 4x4s and pick-ups registered, in line with new information from the Society of Motor Producers and Merchants (SMMT).

This marks the sixth consecutive month-to-month decline and the weakest Could efficiency since 2022, as low enterprise confidence continues to suppress fleet renewal.

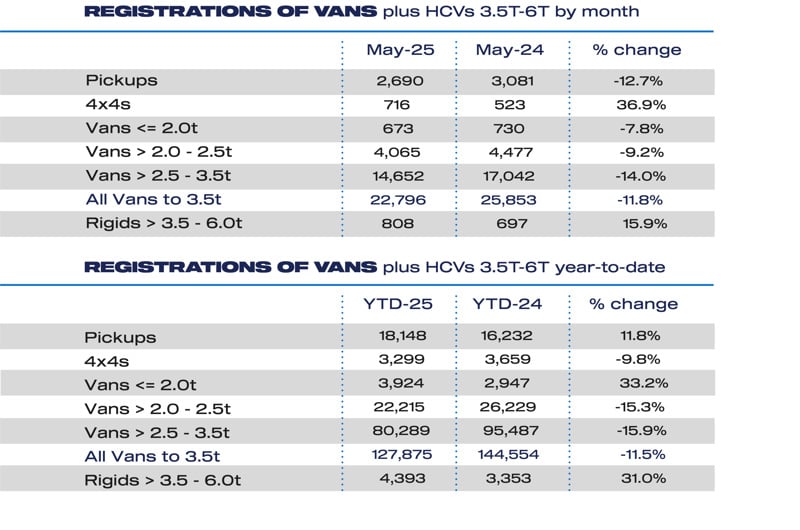

Demand fell throughout practically all segments. Massive van registrations dropped -14.0%, medium vans had been down -9.2%, and small vans declined by -7.8%. Pickup registrations additionally slid by -12.7%, following the introduction in April of recent tax guidelines that deal with double-cabs as vehicles for benefit-in-kind and capital allowance functions.

The change is already having an influence on crucial sectors like development, farming and utilities, whereas the one space of development got here from the brand new 4×4 section, which rose by 36.9%.

The SMMT is warning that the tax modifications danger retaining older automobiles on the street for longer whereas additionally decreasing authorities income resulting from falling gross sales. The organisation is looking for the reforms to be postponed by a minimum of a yr, giving the market extra time to adapt as extra low- and zero-emission fashions turn into accessible.

Bev of Progress

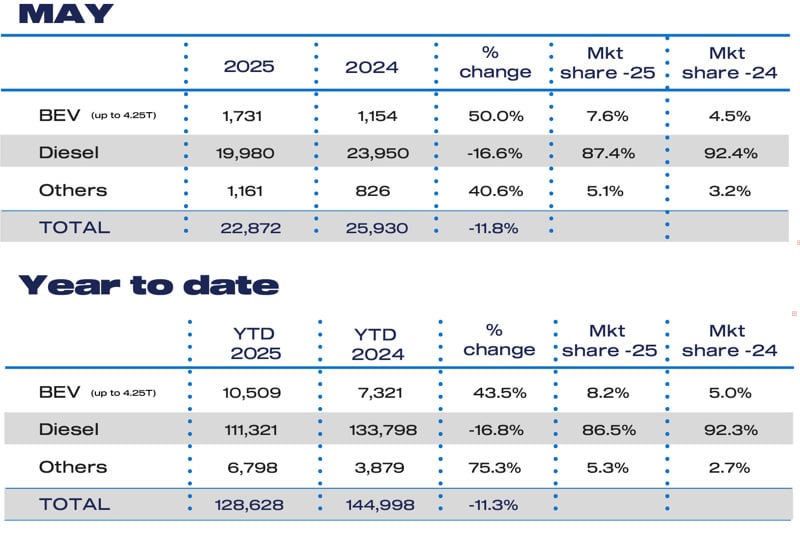

Regardless of the broader downturn, battery electrical vans (BEVs) continued their upward development, with registrations rising by 50.0% to 1,731 models in Could.

That is the seventh consecutive month of development, reflecting producers’ funding in electrification and a rising vary of BEV fashions on supply.

Nevertheless, electrical vans nonetheless made up simply 7.6% of the entire market in Could and eight.2% yr up to now – half the 16% share mandated by the Zero Emission Car Mandate for 2025.

The SMMT stated that whereas the Plug-in Van Grant stays essential, the tempo of charging infrastructure funding should enhance considerably to help the transition.

Public, depot and shared hub charging options have to be developed at scale, with preferential therapy for depot grid connections – presently topic to attend instances of as much as 15 years – seen as very important. Streamlined planning insurance policies on the native stage can even be key to giving companies the boldness to modify to electrical fleets.

Mike Hawes, SMMT chief govt, stated: “Six months of declining new van demand displays a tricky financial setting and weak enterprise confidence – and that received’t be helped by punitive taxes reminiscent of on double-cabs that may solely limit wider development.

“Fleet renewal with the newest, cleanest fashions have to be inspired so it’s constructive that zero emission van uptake is rising, however with market share at simply half the mandated stage, it’s clear we want motion to drive that uptake sooner. Accelerating LCV-centric and reasonably priced chargepoint rollout is the daring subsequent step that van operators and producers want now.”

NFDA concern

“Could’s figures mark one other month of lower-than-expected mild business automobile registrations, reflecting continued strain in the marketplace” stated Sue Robinson, chief govt of the Nationwide Franchised Sellers Affiliation (NFDA), which represents franchised automotive and business automobile retailers.

“The slowdown throughout conventional van segments is regarding, significantly within the 2.5-3.5t class, which continues to symbolize the most important share of the UK’s LCV market.

“The current Profit-in-Type tax modifications have additionally had a direct influence on the pick-up section, which noticed a 12.7% fall in registrations.

“On a constructive word, electrical van registrations proceed to rise, with a 53.7% year-on-year enhance. Nevertheless, with BEVs accounting for simply 8.2% of the market – effectively under the mandated goal – this highlights ongoing issues amongst consumers across the practicalities of working electrical LCVs.”