Main Chinese language multinational sportswear firm ANTA Sports activities Merchandise Restricted (or ANTA Sports activities for brief) has acquired a 29.06 p.c stake within the PUMA Group for about USD 1.7 billion, making it the German sportswear model’s largest single shareholder. ANTA Sports activities is at the moment positioned because the world’s third-largest sportswear firm by income behind Nike and Adidas. Stopping wanting a full takeover, the all-cash funding for a 29 p.c stake in PUMA sees ANTA Sports activities set to strengthen its place throughout practically each main sporting class.

PUMA’s Regional Progress Beneficial properties Momentum

PUMA at the moment has a considerable foothold in style, soccer and motorsports and has been actively driving regional development by means of a collection of activations and model partnerships throughout Southeast and East Asia. In 2025, ANTA Malaysia launched the nation’s first-ever ANTA Superstore, stating on the time that ANTA’s intensive vary of high-performance sportswear — from modern trainers to versatile coaching attire — was designed to fulfill the wants of each Malaysian client.

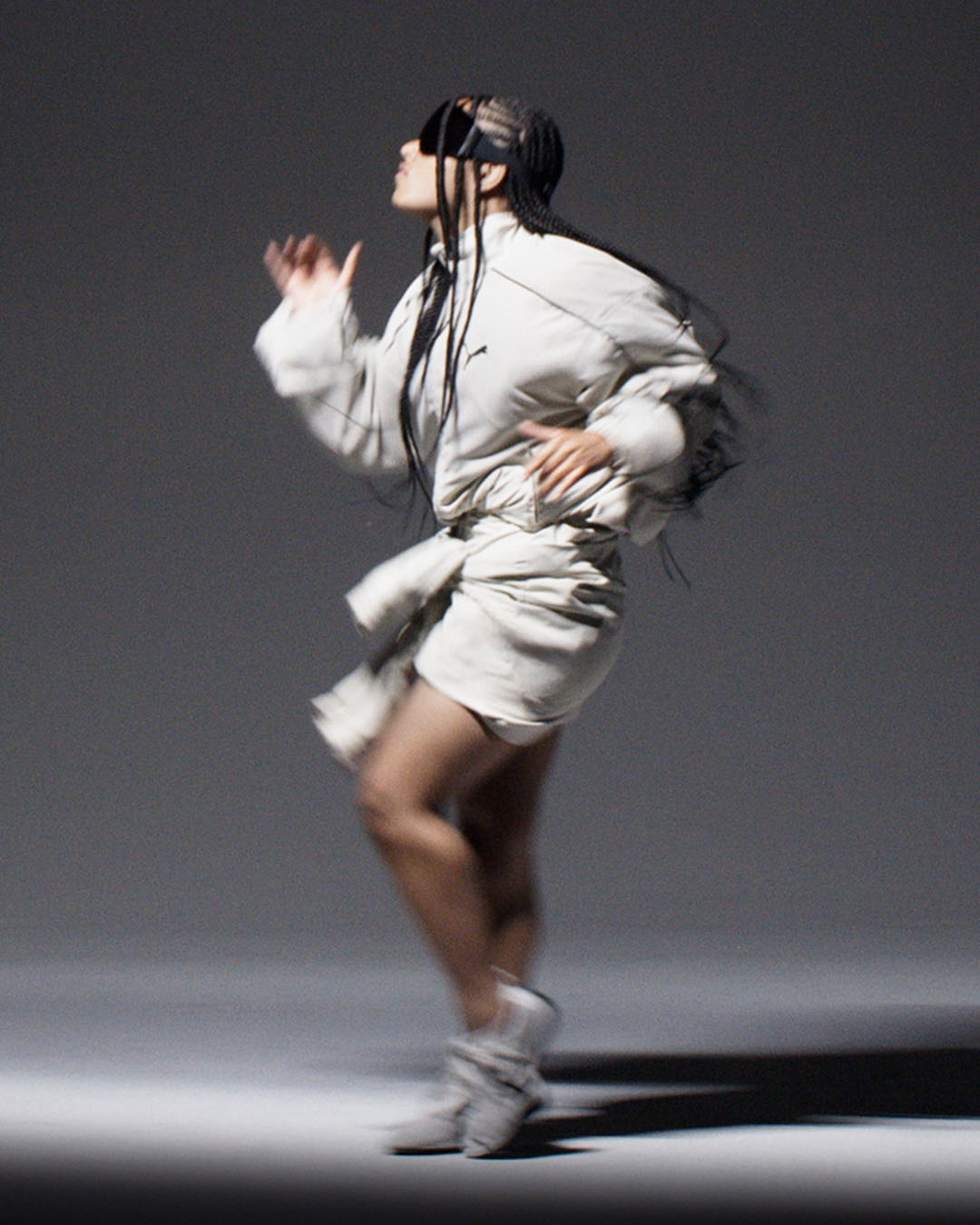

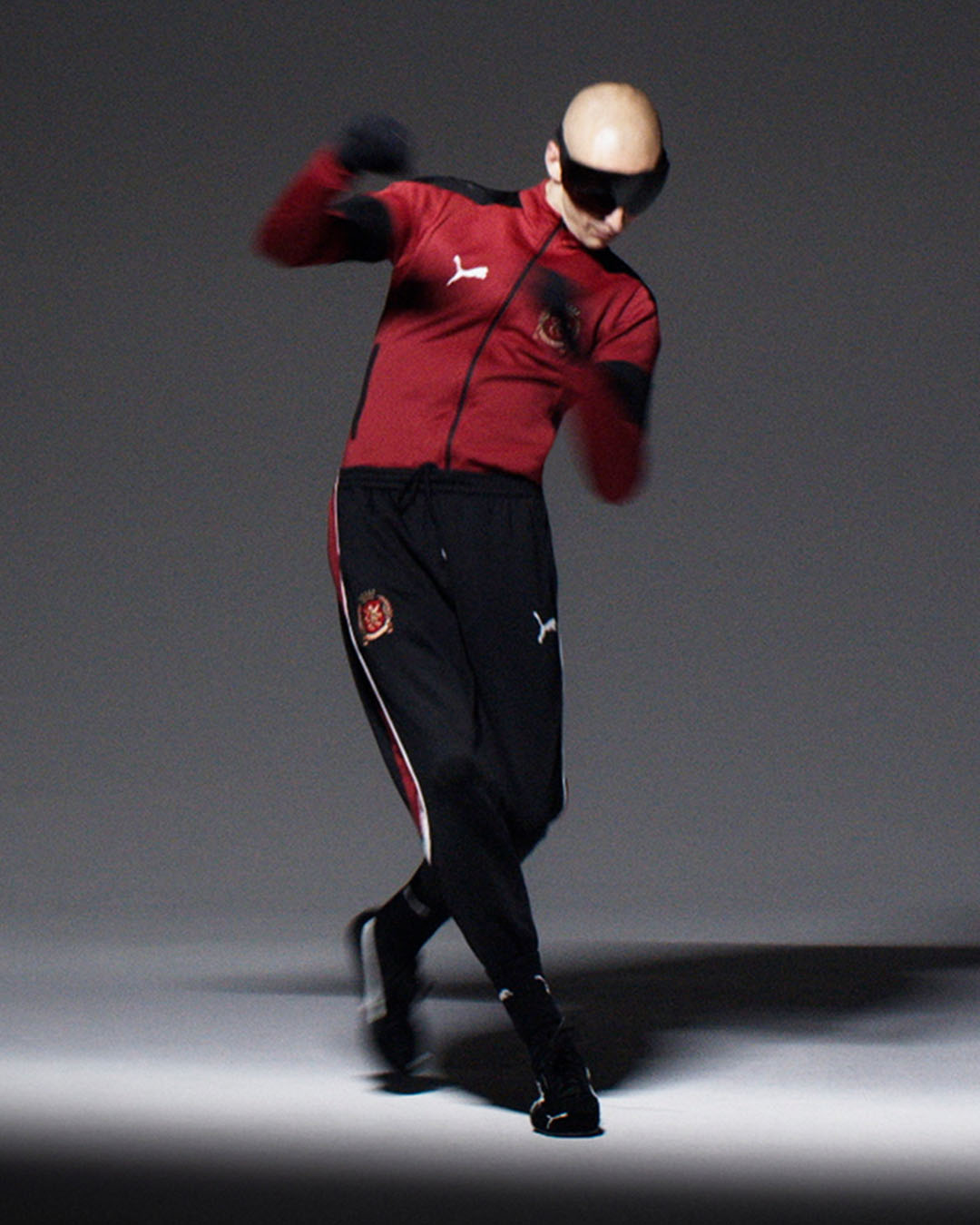

In September, PUMA unveiled an immersive world launch expertise in Shanghai for the PUMA x Rosé collaborative assortment. A celeb endorsement of this scale represents a significant win for PUMA, with Rosé rating among the many most influential figures in world popular culture. Commenting on the collaboration, Rosé stated, “Working with the PUMA staff to carry the PUMA x Rosé assortment to life has been a satisfying journey, and celebrating its launch feels very particular. It’s an unbelievable expertise to see the marketing campaign come to actuality and to see how individuals creatively fashion the items in their very own approach.”

Cultural Affect Meets Motorsports Credentials

In 2026 alone, PUMA introduced a multi-year world partnership with McLaren Racing, aiming to “carry followers nearer to the motion and permit them to expertise the true spirit of racing.” As a part of the partnership, PUMA will design and produce official staff kits. The collaboration will span the whole McLaren Racing portfolio, together with the McLaren Mastercard Components 1 Staff, the Arrow McLaren IndyCar Staff, each McLaren Racing entries in F1 Academy, the McLaren F1 Sim Racing Staff and — as of 2027 — the McLaren United AS WEC Hypercar Staff.

One of many clearest expressions of this repositioning is PUMA’s rising presence in luxurious style. In June 2025, the model launched a high-profile collaboration with Balenciaga, unveiled as a part of the French home’s Winter 25 assortment. The partnership reimagined PUMA’s famed Speedcat sneaker and prolonged into luxurious ready-to-wear, underscoring PUMA’s efforts to rebuild cultural relevance past conventional sportswear classes.

PUMA’s Turning Level

Regardless of its wide selection of actions and collaborative launches, 2025 additionally proved to be a difficult 12 months for PUMA when it comes to sustaining revenue margins. In October, the corporate introduced plans to chop an additional 900 jobs and sharpen its concentrate on working, soccer and coaching, because the German model appears to rebound from its latest stoop. PUMA reported third-quarter gross sales and earnings that fell wanting analyst estimates, partly because of the influence of forex fluctuations, which lowered gross sales by roughly USD 145 million. The corporate additionally famous that 2026 could be a “transition 12 months.” Based on stories, PUMA has already eradicated round 500 roles below its cost-savings programme and now plans to scale back headcount by a further 900 white-collar positions by the tip of 2026.

Lately, PUMA has struggled to persistently resonate with customers and has misplaced floor to bigger rivals corresponding to cross-town rival Adidas AG, in addition to fast-growing manufacturers like On Holding AG and Hoka, amid an more and more aggressive sportswear and athleisure panorama. This will partly clarify why PUMA has been cementing its presence throughout adjoining classes, increasing past its conventional sportswear roots into luxurious style and performance-driven motorsports.

The ANTA & PUMA Powerhouse

That is the place ANTA Sports activities enters the image. What ANTA lacks in heritage, it makes up for in technique. The group has established a robust monitor file of management in China, supported by a particular model and retail mannequin, alongside a broader enlargement throughout Asia. PUMA, in contrast, brings greater than 75 years of heritage, with retail operations in over 120 nations and a robust presence throughout Europe, the Americas and Africa. With the addition of PUMA to a portfolio that already spans FILA (China) and the Amer Sports activities group (Arc’teryx, Salomon, Wilson), ANTA has cemented its place throughout nearly all main world sports activities classes. ANTA’s shareholder place might subsequently allow a “single-focus, multi-brand” globalisation technique able to rivaling business leaders corresponding to Adidas and Nike.

For extra on the newest in luxurious and enterprise reads, click on right here.