September’s new-vehicle sale tempo is predicted to complete close to 16.2 million, up from final yr’s 15.8 million degree and better than August’s 16.1 million

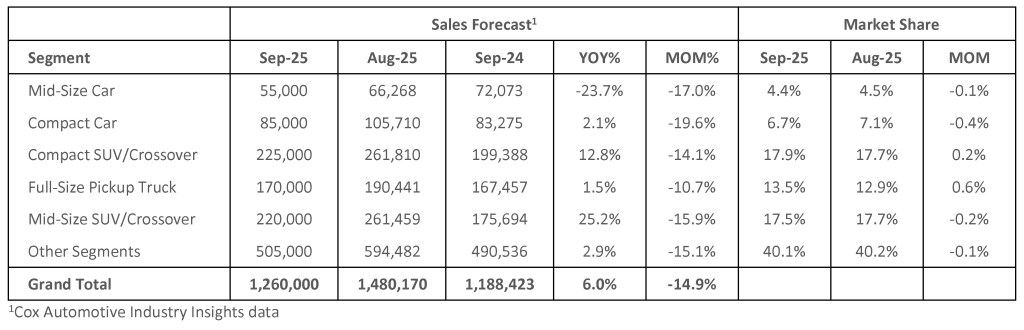

September new-vehicle gross sales are anticipated to indicate a resilient market that continues to shake off important coverage adjustments and financial uncertainty. The September new-vehicle SAAR, or seasonally adjusted promoting charge, is predicted to complete close to 16.2 million, a rise from final yr’s 15.8 degree and a slight uptick from final month’s 16.1 million tempo. Gross sales quantity is predicted to rise 6.0% from final yr however decline 14.9% from the earlier month because of three fewer promoting days.

“The brand new-vehicle gross sales tempo has been surprisingly sturdy this summer season and thru the third quarter as uncertainty round tariff coverage has decreased,” stated Charlie Chesbrough, senior economist at Cox Automotive. “Continued low inflation and unemployment charges, coupled with a robust inventory market, have saved shoppers in a shopping for temper. A key contributor to gross sales in latest months has been a rise in EV gross sales, as consumers rush to market earlier than the $7,500 tax credit expire on the finish of September.”

September 2025 new-vehicle gross sales forecast

Q3 electrical automobile gross sales poised to set document

With a surge of EV consumers in market earlier than the tip of government-supported tax incentives, Cox Automotive is forecasting {that a} document 410,000 EVs might be offered within the third quarter, a big enhance (21.1%) yr over yr and a soar of greater than 30% in comparison with Q2. The share of EV gross sales within the third quarter will seemingly be near 10% of complete gross sales, a document. The earlier EV gross sales peak within the U.S. was This fall 2024, when 365,824 EVs have been offered, accounting for 8.7% of complete new-vehicle gross sales.

“The federal tax credit score was a key catalyst for EV adoption, and its expiration marks a pivotal second,” stated Stephanie Valdez Streaty, director of Business Insights at Cox Automotive. “This shift will take a look at whether or not the electrical automobile market is mature sufficient to thrive by itself fundamentals or nonetheless wants assist to broaden additional.” Cox Automotive expects EV gross sales to gradual notably in This fall, however long-term gross sales development will proceed. For extra on what’s subsequent, learn Valdez Streaty’s newest publish: After the Credit: How EV Adoption Advances When Incentives Fade.

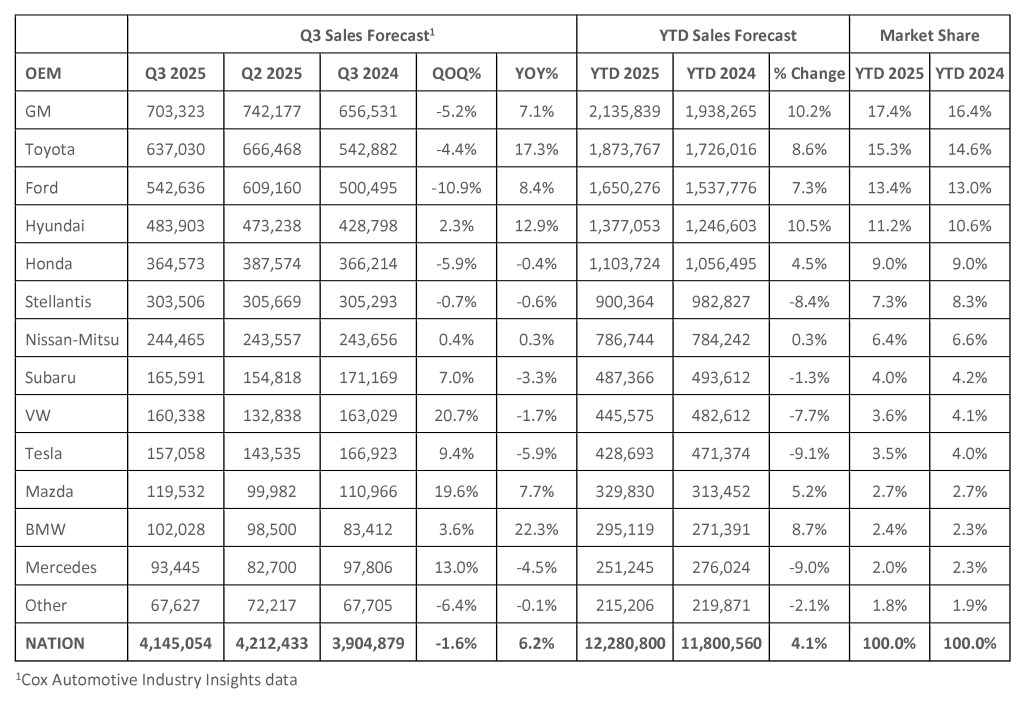

Q3 andyear-to-date 2025 new-vehicle gross sales forecast

Cox Automotive is forecasting Q3 2025 new-vehicle gross sales to climb yr over yr by 6.2%, though they’re projected to complete decrease in comparison with Q2 by 1.6%. The year-over-year quantity positive aspects available in the market are anticipated to be pushed nearly solely by the 4 largest automakers – Common Motors, Toyota Motor Company, Ford Motor Firm, and Hyundai Motor Firm. Cox Automotive forecasts the “Large 4” in Q3 to publish mixed gross sales positive aspects of 11.2% yr over yr. The remainder of the business is predicted to be greater by 0.1%. Yr up to now, the story stays the identical, with the Large 4 forecasted to realize 9.1 % whereas the opposite automakers decline by 2.0%.

Q3 2025 new-vehicle gross sales forecast

Chesbrough added, “The gross sales tempo within the new-vehicle market is predicted to wane within the coming months, as extra headwinds collect. Gross sales of EVs are more likely to decline considerably, and market situations for different autos will grow to be tougher within the close to future. Extra tariffed merchandise are changing current stock, and costs are anticipated to be pushed greater as automakers cross alongside greater import prices. Nonetheless, the market’s energy in Q3 has improved our total outlook.”

Cox Automotive is elevating its full-year forecast vary to between 15.8 and 16.4 million, whereas rising the baseline quantity to 16.1 million, the seemingly final result for full-year gross sales. On the finish of Q2, Cox Automotive had adjusted its baseline forecast to fifteen.7 million, however wholesome gross sales and the big surge in EV quantity throughout Q3 have led the Cox Automotive workforce to shift its outlook. Forecasts for each fleet gross sales and new retail gross sales have been adjusted greater. With an anticipated decline in EV leasing in This fall, the lease penetration forecast was moved decrease, from 25% to 24% for the Q3 forecast. Used retail gross sales and gross sales of CPO autos have been additionally adjusted greater.

SOURCE: Cox Automotive