As soon as hailed as a monetary lifeline for a struggling publishing home, the 2022 acquisition of Éditions Jalou by Chinese language monetary group AMTD is now on the centre of a authorized and legal investigation that would threaten the way forward for considered one of style’s luxurious titles.

French authorities have confirmed that an investigation into suspected large-scale fraud is underway following a criticism lodged by the Jalou household, founders of the publishing home behind L’Officiel. The criticism was formally filed on 5 March 2025 and the case has been assigned to the monetary investigations unit of the Paris judicial police. What started as a company rescue has since advanced right into a multi-jurisdictional dispute spanning Europe, Asia and offshore monetary centres.

On the coronary heart of the authorized motion is the allegation that AMTD Group — alongside its subsidiaries together with AMTD Digital and The Era Necessities Group — prioritised monetary engineering over accountable stewardship. The Jalou household is searching for no less than EUR 40 million in damages to collectors and accuses the group of stripping property from the century-old style establishment whereas it remained below court docket supervision.

From Rescue to Receivership Fallout

Based in 1921, Éditions Jalou was lengthy thought to be a cornerstone of French style publishing, overseeing titles corresponding to “L’Officiel de la mode”, “Jalouse” and “L’Optimum”. The group additionally beforehand owned “The Artwork Newspaper” — one other internationally influential cultural title — earlier than each property had been offered to AMTD. Its decline started within the mid-2010s following a expensive authorized dispute in Russia, culminating within the firm being positioned into receivership in 2022.

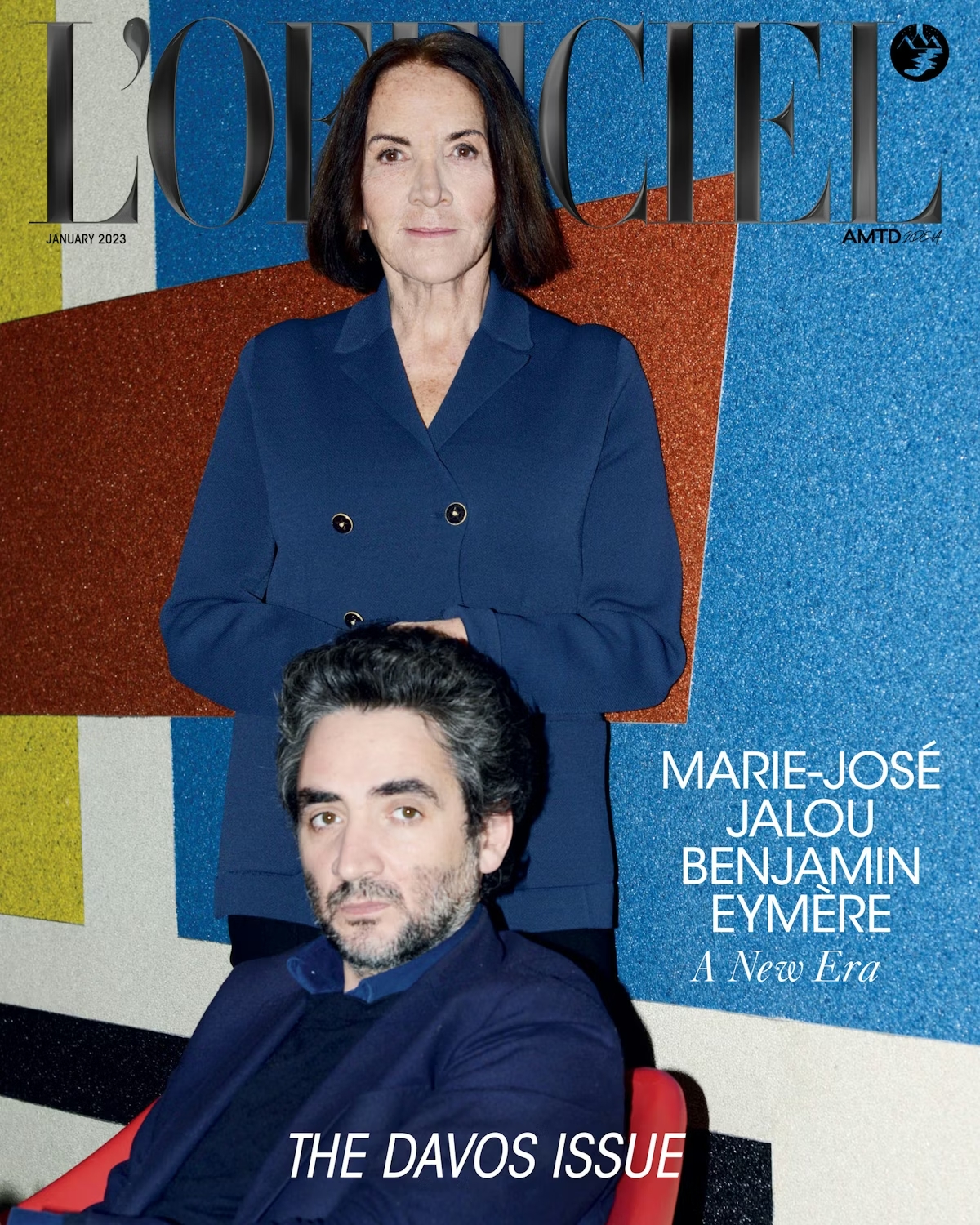

AMTD — a Hong Kong-based conglomerate with a various portfolio spanning throughout digital options, media, leisure and hospitality — offered itself as one thing of a “white knight” able to stabilising the enterprise. The acquisition was accompanied by high-profile gestures designed to sign revival, together with a particular version unveiled on the World Financial Discussion board in Davos and a style present staged on the New York Inventory Change. Nonetheless behind the spectacle, the connection between purchaser and vendor was already fraying. In response to authorized filings reviewed by French authorities, the Jalou household alleges that the takeover masked a “predatory” operation aimed toward hollowing out the French entity moderately than rebuilding it.

Allegations of Fraud, Trademark Abuse and Lacking Belongings

The criticism accuses AMTD of counterfeiting, tax fraud, trademark infringement and misuse of firm property. Central to the case are claims {that a} collection of opaque monetary buildings spanning Paris, New York, Hong Kong, the Cayman Islands and the British Virgin Islands had been used to divert worth away from Éditions Jalou.

One key allegation considerations the illegal registration of the “L’Officiel” trademark in round 40 nations by means of a international subsidiary based mostly within the British Virgin Islands, regardless of the restoration plan explicitly prohibiting any switch or disposal of the model. The household additional alleges that licensing agreements had been terminated and reassigned to abroad entities, depriving the French writer of income whereas increasing AMTD’s management overseas.

Among the many most alarming accusations is the disappearance of L’Officiel’s photographic archives, a novel visible document documenting greater than a century of French style and tradition. The household maintains that the whereabouts of those archives stay unknown. The Jalou household additionally claims that proceeds from the sale of the enterprise had been by no means totally paid. They allege that AMTD didn’t settle the total buy value for each “L’Officiel” and “The Artwork Newspaper,” whereas parts of the funds that had been due stay frozen inside AMTD-controlled accounts.

On the similar time, they argue that AMTD exploited the L’Officiel model throughout worldwide markets — notably in Asia and the Center East the place the journal maintains a large publishing footprint — with out income flowing again to the French entity. Worldwide licensees had been reportedly instructed to bypass Éditions Jalou altogether and deal straight with the brand new house owners, successfully severing the unique firm from its most useful asset.

Tax Claims and Regulatory Scrutiny

One other pillar of the case considerations alleged tax evasion. The Jalou household accuses AMTD of seizing management of the L’Officiel model — which they worth at practically EUR 85 million — as a part of a scheme designed to keep away from French tax obligations. They argue that these actions straight contravened the court-approved restoration plan established when the corporate entered receivership. That plan — which runs till 2028 — explicitly restricts the switch or sale of property and emblems with the intention to shield staff, suppliers, URSSAF and the French state.

In response to the criticism, AMTD dedicated “severe and repeated violations” of those circumstances, undermining the very framework that allowed the acquisition to proceed. Marie-José Jalou — the journal’s former editor-in-chief and considered one of its most distinguished figures — has described the scenario as devastating. “L’Officiel was the bible of style,” she mentioned. “It can’t be handled as a speculative asset. I’ll by no means hand over.”

The dispute has additionally expanded past France. Regardless of ongoing authorized proceedings, AMTD has listed each “L’Officiel” and “The Artwork Newspaper” as media property on the London and New York inventory exchanges, a transfer that has additional infected tensions between the events. The group’s founder — Chinese language financier Calvin Choi — is now straight named in a number of of the disputes.

The case unfolds towards a broader backdrop of scrutiny surrounding AMTD, which has confronted separate regulatory points and authorized proceedings involving the Hong Kong Securities and Futures Fee. For the Jalou household’s authorized staff, the difficulty extends past a business disagreement. “L’Officiel is a century-old French style establishment,” their attorneys, Céline Bekerman and Antoine Cadeo, mentioned. “Its heritage have to be preserved and can’t be sacrificed for predatory practices.”

As investigators work by means of an internet of cross-border transactions, disputed trademark registrations and unpaid proceeds, the way forward for “L’Officiel” stays unsure. What started as a rescue operation has advanced right into a cautionary story concerning the dangers dealing with heritage media manufacturers in an period of world capital. Whatever the final result, the case underscores a broader rigidity in a globalised market, the place style and cultural establishments threat being subordinated to monetary engineering moderately than protected as heritage property.

AMTD Pushes Again with Defamation Lawsuit

In January 2026, AMTD Group and its subsidiaries introduced that that they had launched authorized proceedings towards Benjamin Eymere — a member of the Jalou household and former worker of an AMTD subsidiary, alleging malicious falsehood, defamation and misconduct. The group claims Eymere was dismissed for mismanagement, that subsequent appeals within the Paris courts had been dismissed and that his current actions prompted AMTD to contain legislation enforcement. AMTD additionally rejected what it described as inaccuracies circulating in press and social media, stating that its 2022 acquisition of L’Officiel was totally accomplished with one hundred pc of the acquisition value paid, that the controlling vendor was funding group GEM moderately than the Jalou household and that L’Officiel has not incurred new debt for the reason that takeover. The corporate mentioned it might proceed to pursue authorized motion to defend its popularity, positioning itself as a lawful proprietor appearing to counter allegations made by the journal’s founding household.

For extra on the most recent in enterprise and finance reads, click on right here.