Whereas tariffs have launched higher volatility into new-vehicle buying habits, manufacturers with sturdy reputations—equivalent to Toyota and Honda—proceed to retain loyal clients, in response to the J.D. Energy 2025 U.S. Automotive Model Loyalty Research,SM launched at this time. Within the present aggressive panorama, automakers that constantly ship autos aligned with evolving buyer expectations and wishes are finest positioned to keep up and develop their loyal base.

“Model loyalty issues to automobile consumers as a result of it’s usually related to increased residual values, making autos from trusted manufacturers a extra financially sound selection over time,” mentioned Tyson Jominy, senior vp of information & analytics at J.D. Energy. “Nonetheless, purchaser loyalty tends to weaken when shifting to a distinct automobile phase. Not solely that, however altering market circumstances, equivalent to elevated availability of fashions, various age of merchandise and extra aggressive incentive presents, have additionally introduced model loyalty again beneath 50% after ending at 51% final 12 months. Model loyalty averages 49% throughout all nameplates and segments on this 12 months’s research.”

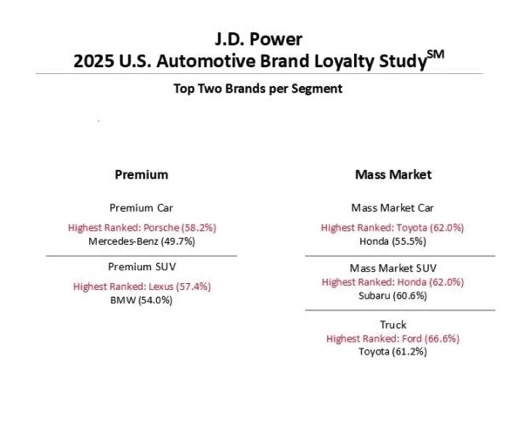

Highest-Rating Manufacturers

Porsche ranks highest amongst premium automobile manufacturers for a fourth consecutive 12 months, with a 58.2% loyalty fee. Mercedes-Benz (49.7%) ranks second.

Lexus ranks highest amongst premium SUV manufacturers for a second consecutive 12 months, with a 57.4% loyalty fee. BMW (54.0%) ranks second.

Toyota ranks highest amongst mass market automobile manufacturers for a fourth consecutive 12 months, with a 62.0% loyalty fee. Honda (55.5%) ranks second.

Honda ranks highest amongst mass market SUV manufacturers for a second consecutive 12 months, with a 62.0% loyalty fee. Subaru (60.6%) ranks second.

Ford ranks highest amongst truck manufacturers for a fourth consecutive 12 months, with a 66.6% loyalty fee—the best loyalty fee within the research. Toyota (61.2%) ranks second.

The U.S. Automotive Model Loyalty Research, now in its seventh 12 months, makes use of information from the Energy Info Community® (PIN) to calculate whether or not an proprietor bought the identical model after buying and selling in an present automobile on a brand new automobile. Buyer loyalty relies on the proportion of car homeowners who select the identical model when buying and selling in or buying their subsequent automobile. Solely gross sales at new-vehicle franchise sellers qualify. The research contains model loyalty throughout 5 segments: premium automobile; premium SUV; mass market automobile; mass market SUV; and truck.

The 2025 research calculations are primarily based on transaction information from September 2024 by way of August 2025 and embrace all mannequin years traded in for a brand new automobile.