The expertise of buying and selling can appear each thrilling and complicated initially. New merchants enter with plenty of confidence however encounter unexpected challenges. Understanding the commonest errors could save one from pointless losses. Learn on to acquire easy, actionable recommendation that lets you commerce wiser and fewer burdened.

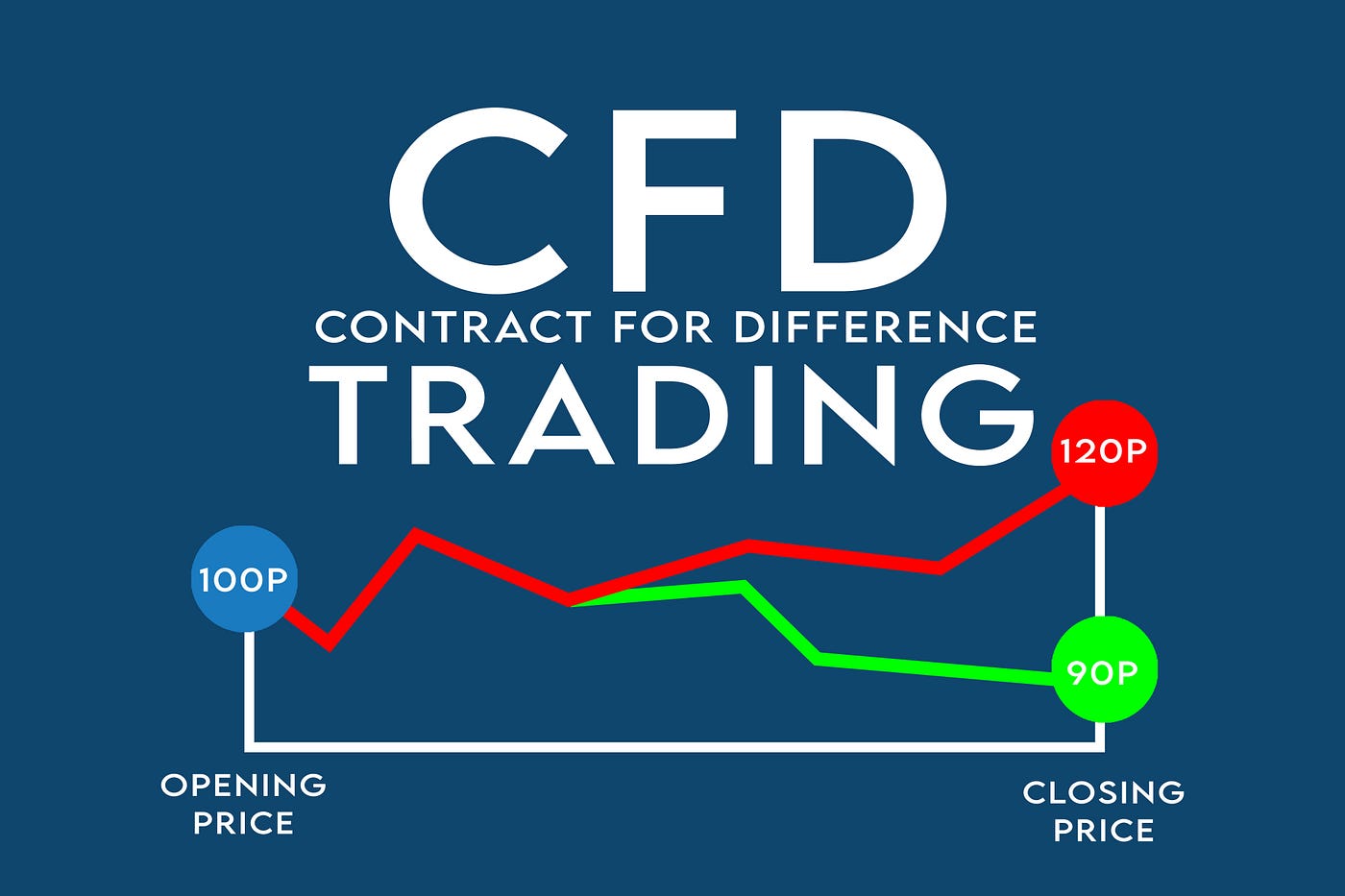

Many newcomers rush into cfd buying and selling (cfd buying and selling) with out preparation. They give attention to fast wins as a substitute of regular progress. This method creates stress and results in expensive choices. Understanding what to keep away from offers a transparent path ahead. Taking time to study fundamentals units a powerful basis. It permits merchants to reply calmly to sudden market modifications. Information of instruments and platforms makes execution smoother.

1. Unrealistic Revenue Expectations

New merchants often begin imagining massive income as quickly as they begin. They count on on the spot wins that hardly ever occur. Markets transfer step by step and barely reward impulsive actions. Unrealistic objectives convey frustration and poor selections. Setting achievable targets retains focus and persistence. Small good points construct confidence over time. Monitoring progress helps establish what works. Specializing in consistency creates long-term progress. Accepting small setbacks as a part of studying retains motivation excessive. Accepting small setbacks as a part of the training course of retains motivation excessive.

2. Important Analysis Uncared for

Market analysis gaps create blind spots. Some newcomers belief suggestions from associates or observe headlines blindly. This could result in avoidable errors. Studying charts, developments, and market conduct provides readability. A bit effort in analysis prevents main setbacks. Understanding the fundamentals creates a stronger grasp of trades. Over time, analysis turns into a dependable behavior that improves outcomes. Utilizing a number of sources will increase the accuracy of insights. Documenting findings helps spot repeating patterns and alternatives.

3. Extreme Leverage Use

Leverage could make returns appear tempting. New merchants usually take positions too giant for his or her accounts. Excessive leverage magnifies losses rapidly. Managing commerce sizes protects capital and reduces stress. Beginning with smaller positions teaches persistence and management. Gradual expertise with leverage builds confidence with out pointless danger. Sensible place sizing retains buying and selling sustainable. Studying how leverage works prevents shock losses. Managed publicity permits testing methods for use safely. Understanding the boundaries of leverage helps keep constant progress.

4. Absence of a Buying and selling Plan

A commerce with no plan is dangerous. A structured plan outlines entries, exits, and limits. It brings consistency in unpredictable markets. Following a plan improves self-discipline and decision-making. Novices with a plan expertise fewer regrets and higher outcomes. Adjusting the plan over time retains methods related. Planning first ensures every commerce has goal. A transparent plan reduces second-guessing throughout unstable actions. Reviewing the plan after every commerce sharpens future choices. Sticking to a plan builds confidence and helps obtain regular progress.

5. Choices Pushed by Feelings

Feelings affect many newcomers. Concern may cause hasty exits. Pleasure may push trades that really feel tempting. Protecting calm permits clear judgment and prevents errors. Easy methods, like pausing earlier than appearing, assist keep management. Reviewing previous trades builds consciousness of emotional patterns. Calm, rational choices create a secure buying and selling method. Recognizing triggers helps keep consistency. Emotional management protects good points and limits losses. Growing a routine for reflection strengthens long-term self-discipline.

Keep away from these errors to make buying and selling much less tense for newcomers.. Clear objectives, correct analysis, managed leverage, a structured plan, and calm decision-making enhance outcomes. Novices who apply these ideas acquire confidence rapidly. Listening to these elements enhances cfd buying and selling (cfd buying and selling) efficiency. Begin small, keep affected person, and give attention to studying from every commerce. Consistency and reflection assist enhance outcomes steadily. Each step taken rigorously builds stronger expertise over time.

For extra on the newest in enterprise reads, click on right here.