New automobile and industrial automobile manufacturing volumes fall, by -32.8% as a number of challenges beset trade

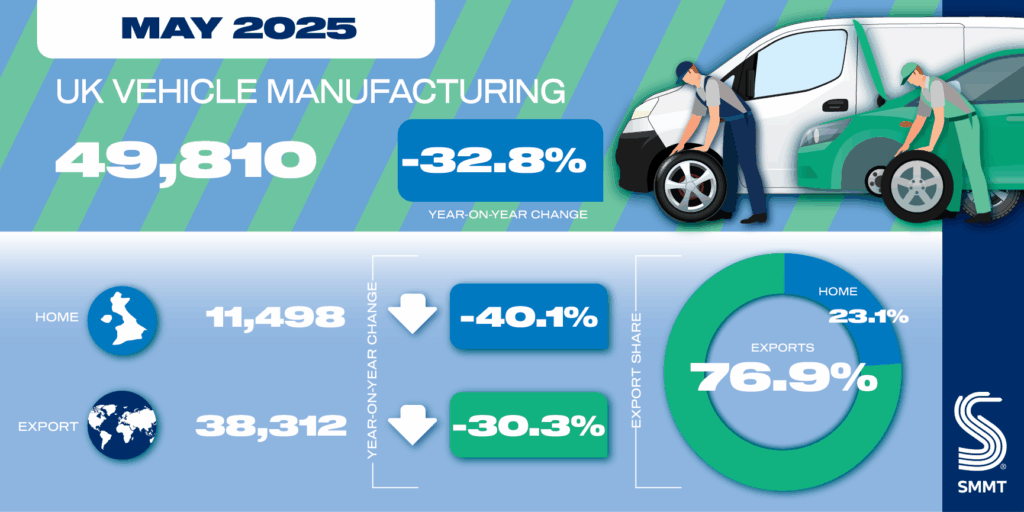

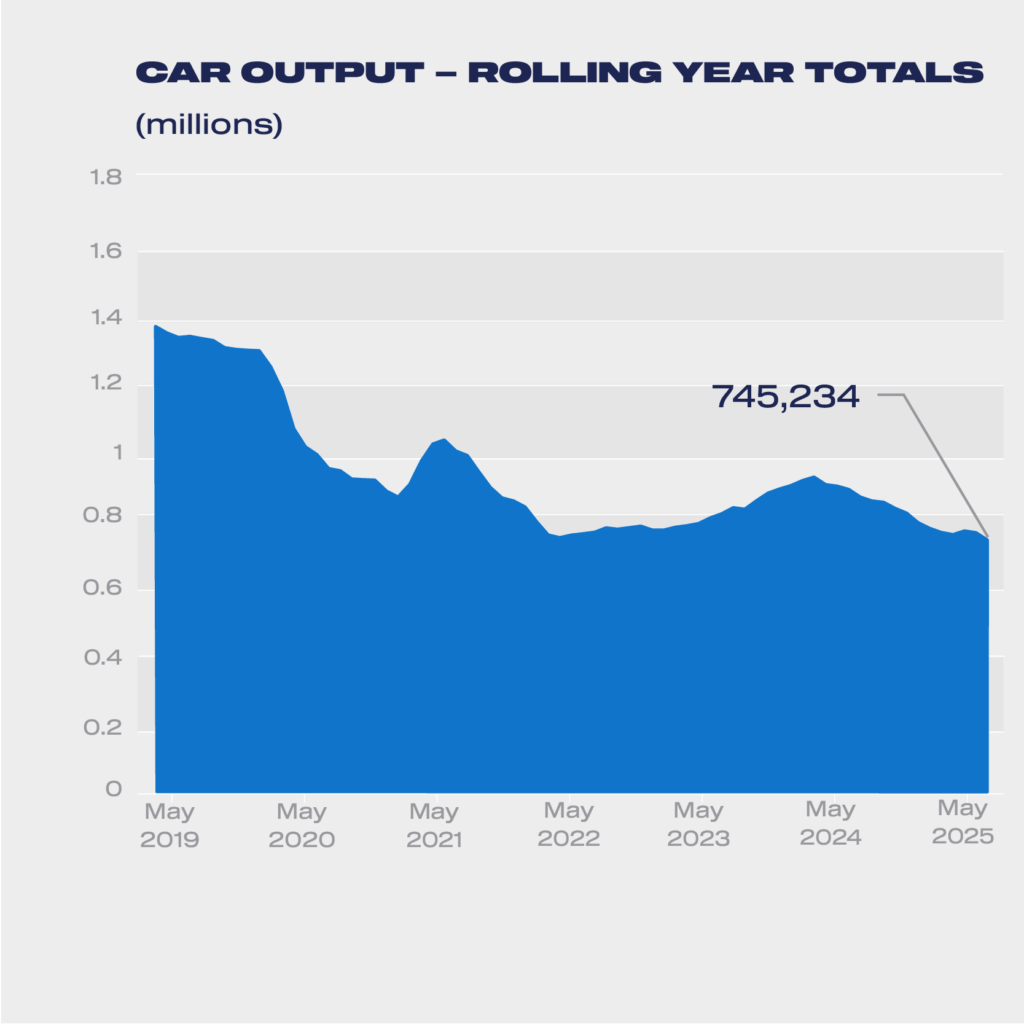

UK automobile and industrial automobile manufacturing fell for the fifth consecutive month in Could, down -32.8% to 49,810 models, in line with the most recent figures printed at this time by the Society of Motor Producers and Merchants (SMMT). Excluding 2020, when Covid lockdowns noticed factories shuttered or working at vastly diminished capability, it was the bottom efficiency for the month since 1949.1 12 months so far, whole output is down -12.9% on 2024, to 348,226, the bottom since 1953.2

Complete automobile manufacturing

| Complete Autos | Could-24 | Could-25 | % Change | YTDLY | YTD | % Change |

|---|---|---|---|---|---|---|

| Manufacturing | 74,150 | 49,810 | -32.8% | 399,752 | 348,226 | -12.9% |

| Dwelling | 19,200 | 11,498 | -40.1% | 106,620 | 85,391 | -19.9% |

| Export | 54,950 | 38,312 | -30.3% | 293,132 | 262,835 | -10.3% |

| % export | 74.1% | 76.9% | 73.3% | 75.5% |

Automotive manufacturing

| Could-24 | Could-25 | % Change | YTD-24 | YTD-25 | % Change | |

|---|---|---|---|---|---|---|

| Complete | 69,652 | 47,723 | -31.5% | 353,843 | 319,493 | -9.7% |

| Dwelling | 17,754 | 10,275 | -42.1% | 92,487 | 70,360 | -23.9% |

| Export | 51,898 | 37,448 | -27.8% | 261,356 | 249,133 | -4.7% |

| % export | 74.5% | 78.5% | 73.9% | 78.0% |

CV manufacturing

| Could-24 | Could-25 | % Change | YTD-24 | YTD-25 | % Change | |

|---|---|---|---|---|---|---|

| Complete | 4,498 | 2,087 | -53.6% | 45,909 | 28,733 | -37.4% |

| Dwelling | 1,446 | 1,223 | -15.4% | 14,133 | 15,031 | 6.4% |

| Export | 3,052 | 864 | -71.7% | 31,776 | 13,702 | -56.9% |

| % export | 67.9% | 41.4% | 69.2% | 47.7% |

Automotive manufacturing declined -31.5% within the month, due primarily to ongoing mannequin changeovers, restructuring and the affect of US tariffs, with 47,723 models rolling off manufacturing unit strains. Business automobile output was additionally down sharply, by -53.6% to 2,087 models, because the closure of one of many UK’s CV crops continues to affect comparisons with final 12 months.

Automotive manufacturing for export fell by -27.8%, though a -42.1% fall in output for the smaller home market meant exports comprised a bigger share of manufacturing, as much as 78.5%. Shipments to the EU and US, the UK’s two largest markets, fell by -22.5% and -55.4% respectively with the US share of exports declining from 18.2% to 11.3%. This was primarily because of the imposition by the US administration of a supplementary 25% Part 232 tariffs on automobiles from March which depressed demand immediately forcing many producers to cease shipments. Nonetheless, with the commerce settlement negotiated by authorities because of come into impact earlier than the tip of June, this could hopefully be a short-lived constraint. Declines have been additionally recorded in exports to China and Turkey, down -11.5% and -51.0% respectively.

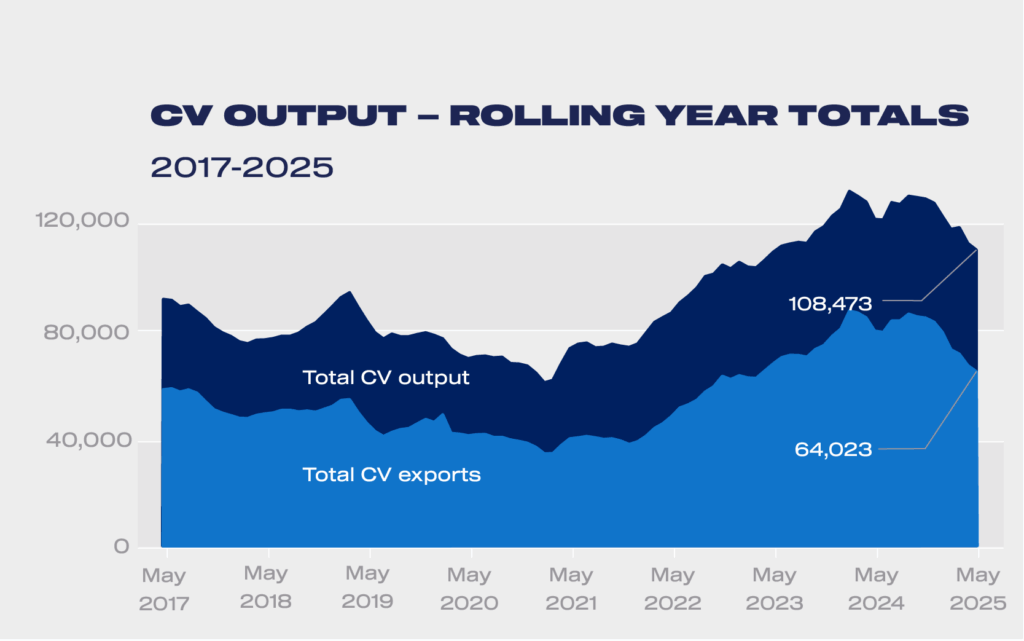

Export volumes of vans, buses, coaches, taxis and vans additionally declined in Could, down by -71.7% 12 months on 12 months. The EU remained overwhelmingly the sector’s largest buyer, accounting for 94.7% of exports, though volumes fell -72.1%. Because of this, the export share of general industrial automobile manufacturing fell from 67.9% to 41.4%, with the home market now the first vacation spot for UK industrial automobile output.3

Whereas general automobile output is presently constrained, with the correct aggressive situations in place, automotive manufacturing can ship important good points for UK jobs, the financial system and decarbonisation. With three main new commerce offers secured with the US, EU and India, the sector has pledged to construct on the federal government’s landmark Industrial and Commerce Methods printed this week. Speedy motion on power prices and an elevated potential to entry key abroad markets – plus extra measures to energise home demand – might put the UK heading in the right direction to reclaim its place within the high 15 automotive manufacturing nations, for the primary time since 2018.4

Mike Hawes, SMMT Chief Government

Whereas 2025 has proved to be an extremely difficult 12 months for UK automotive manufacturing, there may be the beginnings of some optimism for the longer term. Confirmed commerce offers with essential markets, particularly the US and a extra constructive relationship with the EU, in addition to authorities methods on trade and commerce that recognise the vital position the sector performs in driving financial progress, ought to assist restoration.

With fast implementation, significantly on the power prices constraining our competitiveness, the UK can ship the roles, progress and decarbonisation that’s desperately wanted.

1Could 1949: 49,287 models

2Jan-Could 1953: 318,306 models

3Home share of CV manufacturing has been beneath 50% for one quarter, since March 2025

4Industrial Technique may be springboard for UK auto success, 24 June 2025

SOURCE: SMMT