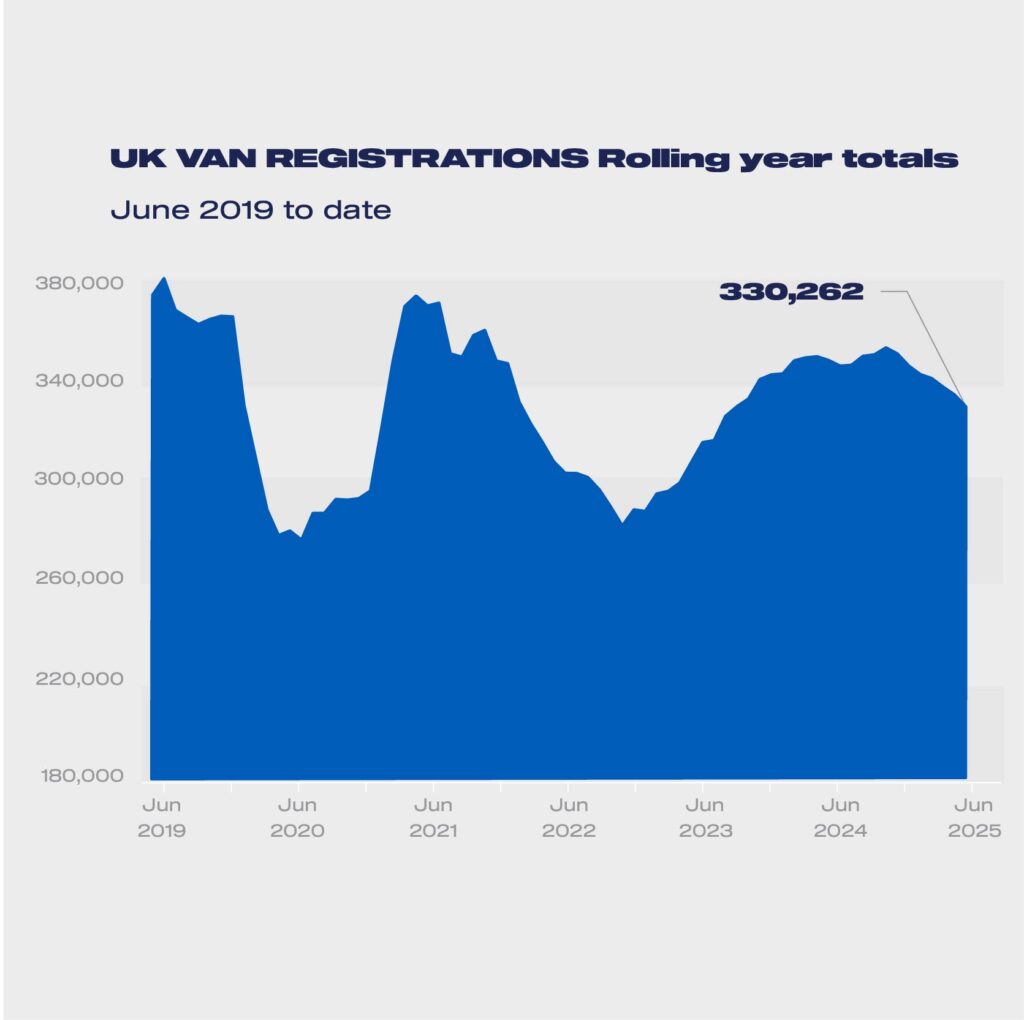

New mild industrial car (LCV) registrations shrank by -12.1% to 156,048 models within the first half of 2025, in line with the newest figures printed right now by the Society of Motor Producers and Merchants (SMMT)

New mild industrial car (LCV) registrations shrank by -12.1% to 156,048 models within the first half of 2025, in line with the newest figures printed right now by the Society of Motor Producers and Merchants (SMMT). With a -14.8% drop in June, the market declined for the seventh consecutive month,1 rounding off the worst opening half-year efficiency since 2022 amid a tricky financial setting and weak enterprise confidence to spend money on fleet renewal.2

Yr-to-date efficiency was led by declining demand for the most important vans, by -14.8% with 99,790 registered, in addition to deliveries of medium sized vans, down -20.9% to 26,408 models. 4×4 uptake additionally fell, by -6.0% to 4,041 models. There was development, nevertheless, in demand for small vans, up 30.7% to 4,907 models, however couldn’t soften the general market decline as a decrease quantity section.

Registrations by section in June

| Jun-25 | Jun-24 | % change | |

| Pickups | 2,754 | 2,776 | -0.8% |

| 4x4s | 742 | 638 | 16.3% |

| Vans <=2.0T | 983 | 806 | 22.0% |

| Vans > 2.0-2.5T | 4,193 | 7,169 | -41.5% |

| Vans >2.5-3.5T | 19,501 | 21,677 | -10.0% |

| All Vans to three.5T | 28,173 | 33,066 | -14.8% |

| Rigids > 3.5 -4.25 t (BEV solely) | 175 | 48 | 264.6% |

| Rigids > 3.5 – 6.0t (Different) | 880 | 556 | 58.3% |

| All rigids | 1,055 | 604 | 74.7% |

Registrations by section year-to-date 2025

| YTD-25 | YTD-24 | % change | |

| Pickups | 20,902 | 19,008 | 10.0% |

| 4x4s | 4,041 | 4,297 | -6.0% |

| Vans <= 2.0t | 4,907 | 3,753 | 30.7% |

| Vans > 2.0 – 2.5t | 26,408 | 33,398 | -20.9% |

| Vans > 2.5 – 3.5t | 99,790 | 117,164 | -14.8% |

| All Vans to three.5T | 156,048 | 177,620 | -12.1% |

| Rigids > 3.5 -4.25 t (BEV solely) | 928 | 492 | 88.6% |

| Rigids > 3.5 – 6.0t (Different) | 4,520 | 3,465 | 30.4% |

| All rigids | 5,448 | 3,957 | 37.7% |

Prime new fashions in June

| Finest sellers | June | |

| 1 | TRANSIT CUSTOM | 4555 |

| 2 | TRANSIT | 2878 |

| 3 | TRAFFIC | 1477 |

| 4 | SPRINTER | 1414 |

| 5 | HILUX | 1163 |

| 6 | TRANSPORTER | 1130 |

| 7 | EXPERT | 1083 |

| 8 | CRAFTER | 1002 |

| 9 | RANGER | 961 |

| 10 | TRANSIT COURIER | 902 |

Prime new fashions yr to this point 2025

| Finest sellers | Yr-to-date | |

| 1 | TRANSIT CUSTOM | 24826 |

| 2 | TRANSIT | 13886 |

| 3 | RANGER | 10327 |

| 4 | Vive | 6266 |

| 5 | SPRINTER | 6250 |

| 6 | TRAFFIC | 5793 |

| 7 | HILUX | 5302 |

| 8 | PARTNER | 5205 |

| 9 | Berlin | 5128 |

| 10 | CRAFTER | 4792 |

There was additionally sturdy uptake of latest pickups within the half-year interval, up 10.0% to twenty,902 models, nevertheless, that obscures two consecutive months of decline following April’s introduction of latest fiscal measures to deal with double cabs as automobiles for profit in type and capital allowance functions. The change in remedy is placing extra prices on key enterprise sectors, constraining new orders of the zero and decrease emission fashions that are getting into the market, and conserving extra polluting autos on the highway for longer. The change may even cut back whole tax revenues given the decrease registration volumes. SMMT continues to induce authorities to postpone the measure for not less than one yr in order that trade and operators can higher plan and put together for the change.

Producers proceed to take a position massively in cutting-edge zero emission LCVs and there are actually nearly 40 completely different battery electrical van (BEV) fashions to select from – up from 28 in the primary half of final yr.3 The market is responding, with BEV demand up 52.8% and 13,512 models registered in 2025,4 boosted by a 97.0% leap in deliveries in June. Within the yr to this point, new BEV purchases stay at simply 8.6% of the general market, nevertheless, little greater than half the 16% share mandated by authorities for 2025 with substantial floor to make up within the second half of the yr – a niche which authorities should assist to plug.

Registrations by gas sort in June 2025

| Gasoline Sort | Jun-25 | Jun-24 | % change | % MTD Whole | % MTDLY TOTAL |

| BEV < 3.5t | 2,828 | 1,476 | 91.6% | 10.0% | 4.5% |

| BEV Rigids > 3.5 -4.25 t | 175 | 48 | 264.6% | 0.6% | 0.1% |

| DIESEL < 3.5t | 23,719 | 30,803 | -23.0% | 83.7% | 93.0% |

| OTHERS < 3.5t | 1,626 | 787 | 106.6% | 5.7% | 2.4% |

| Whole | 28,348 | 33,114 | -14.4% | ||

| Gasoline Sort | YTD-25 | YTD-24 | % change | % YTD Whole | % YTDLY Whole |

| BEV < 3.5t | 12,584 | 8,353 | 50.7% | 8.0% | 4.7% |

| BEV Rigids > 3.5 -4.25 t | 928 | 492 | 88.6% | 0.6% | 0.3% |

| DIESEL < 3.5t | 135,040 | 164,601 | -18.0% | 86.0% | 92.4% |

| OTHERS < 3.5t | 8,424 | 4,666 | 80.5% | 5.4% | 2.6% |

| Whole | 156,976 | 178,112 | -11.9% |

The Plug-in Van Grant stays a lifeline for trade, so we await additional particulars of the continued help introduced within the Complete Spending Evaluation. Many companies are nonetheless being held again, nevertheless, by a scarcity of entry to appropriate industrial car charging at public, depot and shared hub areas. Market regulation is simply workable if enough operators can change so authorities should guarantee better entry to LCV-suitable infrastructure throughout the nation. Preferential remedy for depot grid connections can also be a crucial step, given some websites might face waits of as much as 15 years, and constant and environment friendly implementation of native planning coverage would give fleets the arrogance they should transition their operations to zero emissions.

Mike Hawes, SMMT Chief Govt

Half a yr of declining demand for brand spanking new vans displays a troublesome financial local weather and weak enterprise confidence and the truth that this downturn comes simply as trade invests closely to broaden its zero emission LCV providing is especially regarding. Decarbonisation stays a shared ambition however with the EV market greater than a 3rd beneath this yr’s goal, daring measures are wanted to drive demand. Accelerated CV infrastructure rollout, faster grid connections and streamlined planning are actually crucial.

1Since a -8.3% decline in December 2024.

2New LCV registrations, January-June 2022: 144,384 models.

3https://www.smmt.co.uk/demand-for-new-vans-down-in-july-but-2024-market-remains-at-three-year-high/.

4SMMT’s BEV LCV registration knowledge displays the Automobile Emissions Buying and selling Scheme, wherein BEVs weighing >3.5-4.25t contribute in direction of every producer’s goal, along with these weighing ?3.5t.

SOURCE: SMMT