“I used to be instructed what he did was not even against the law,” President Donald Trump quipped to a White Home reporter, moments after pardoning Binance founder Changpeng “CZ” Zhao. Inside hours, Binance’s BNB token surged practically 8 p.c, however the market euphoria belied a wave of authorized aftershocks that analysts say might value way over the USD 50 billion enhance the pardon bestowed.

“Trump’s pardon doesn’t free CZ from guilt, it freezes his conviction,” mentioned Joshua Chuco-chair of the Hong Kong Web3 Affiliation and a senior guide with Prosynergy Consulting, throughout an interview with Blockwind Information. “A pardon forgives — it doesn’t erase.” Chu argues that Zhao could have merely traded an issue of jail for the prospect of boundless civil litigation.

Authorized Mercy, Locked Guilt

CZ’s unique conviction below the U.S. Financial institution Secrecy Act stemmed from failing to implement efficient anti-money-laundering protocols — not embezzlement or fraud. It was “supervisory legal responsibility — failing to forestall others from misusing Binance’s platform,” Chu mentioned. Zhao’s sentence: a company USD 4.3 billion wonderful and 4 months served quietly earlier than Trump’s Oct. 23 pardon.

However what does a pardon actually imply? Solely courts can erase a conviction, Chu emphasised. By accepting the pardon, Zhao forfeited his attraction, cementing the Division of Justice’s case towards him. “Each plaintiff’s lawyer in America simply acquired a brand new Exhibit A,” he quipped.

If accepting the pardon tightened authorized dangers, why did Zhao’s staff take it? Chu suggests it was a calculated retreat to keep away from the dangers and publicity of U.S. authorized discovery, which might have compelled Binance to show over troves of inside communications and audits. However he questioned whether or not Zhao’s attorneys grasped the worldwide penalties. “The U.S. pardon has no extraterritorial power. Hong Kong, Singapore, or Dubai regulators might nonetheless use the identical document as proof,” Chu mentioned.

The October 7 Assault and Civil Publicity

A separate wave of litigation stems from civil lawsuits filed after the October 7 assault. Plaintiffs allege crypto routed by Binance financed arms purchases. As a result of Binance’s KYC and KYB techniques have been missing, sanctioned events transacted freely, Chu defined. U.S. Commodity Futures Buying and selling Fee (CFTC) paperwork even recommend Binance “inspired customers to avoid” controls.

Chu mentioned civil proof simply acquired simpler: “CZ’s conviction is closing and admitted. Each truth used to convict him is frozen. Trump’s pardon confirmed the document.” Now, attorneys can merely quote these findings; they now not need to re-prove them

The International Ripple

Whereas Trump’s clemency could have secured headlines and market surges, world regulators — together with within the EU, UAE and Hong Kong, all Monetary Motion Process Pressure members—might cite the U.S. findings as persuasive precedent. “Trump is the grasp of his jurisdiction,” Chu mentioned. “However his pardon ends at America’s border. Elsewhere, civil and regulatory actions face no impediment.” Regulation corporations in Tel Aviv, London and Singapore are reportedly exploring circumstances mirroring the U.S. mannequin.

Chu warned: “If one (civil swimsuit) wins, others will observe. Binance’s publicity turns into borderless..

Missed Judicial Path

Chu, requested about what Trump might have performed otherwise, described the pardon as a “missed alternative.” With management of Congress and the Supreme Courtroom, Trump might have endorsed a movement to vacate the conviction — a judicial act that erases, not merely suspends, against the law. “That might’ve given CZ actual exoneration,” Chu mentioned. As a substitute, he acquired political absolution. Chu contrasted the transfer with previous monetary clemencies, corresponding to these for Trevor Milton, Mark Bridge, and Ross Ulbricht, which have been home in affect. “You possibly can’t pardon cash flows that cross 200 jurisdictions,” he mentioned.

White Home spokespeople insist the pardon is a part of Trump’s marketing campaign to “finish the battle on crypto.” Critics like Sen. Elizabeth Warren name it a payoff to donors disguised in digital garb. Chu, for his half, performed it protected: “Regardless of the motive, the impact is identical — Trump reworked CZ’s prison danger into civil certainty.

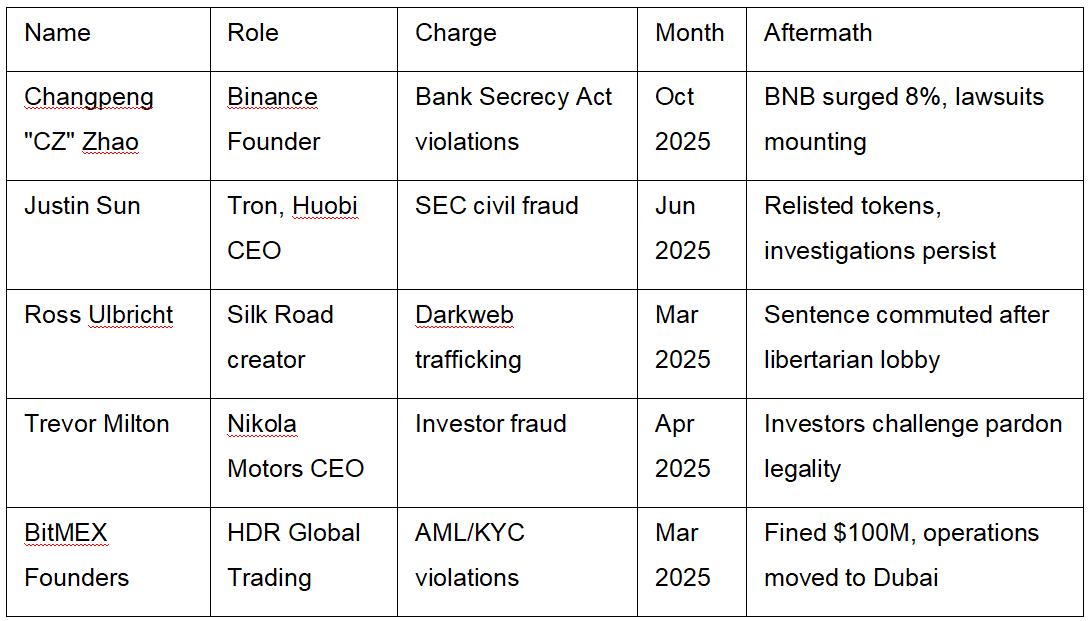

Trump’s?2025?Clemencies?Tied?to?Finance?and?Crypto

Private Legal responsibility Forward

Earlier than conviction, CZ’s “company veil” shielded his property. Now, with a private plea and specific accountability accepted, that safety is eroded. “Opening his pockets to restitution claims shouldn’t be hypothetical — anymore,” Chu mentioned. Plaintiffs could now pursue Zhao’s private wealth as a codefendant, and journey brings ongoing dangers of worldwide subpoenas.

Winston Maadjunct professor at NYU Faculty of Regulation and funding accomplice at a U.S.-based household workplace, sees important limitations to the pardon:

“The U.S. president’s pardon is said to CZ’s particular person case,” mentioned Ma. “Overseas judgments, corresponding to these from Singapore or EU civil awards, might doubtlessly be enforced towards CZ’s U.S. property. Such enforcement may face conflicts of legislation challenges in a cross-border context, however unlikely on account of the pardon.

What Occurs Subsequent?

Analysts predict that 2026 might deliver a historic surge in crypto tort circumstances. Whether or not CZ emerges as a named get together in world litigation will rely on plaintiffs’ creativity — and the diploma of cooperation Binance shows with regulators. However one paradox endures, Chu concluded: “Solely the responsible might be pardoned. By receiving mercy, CZ confirmed the very guilt his traders maintain denying. The markets could have forgiven. Civil legislation seemingly received’t.

This text was initially written by Joe Pan for Blockwind.information.

Joe Pan is an editor and producer at Blockwind Information. An early adopter of blockchain expertise, he has lined main crypto conferences globally since 2019 and moderated Web3 occasions throughout Asia. Joe is a part of the founding staff of Blockwind Information and teaches Asia’s first Grasp of Journalism course on “Masking Cryptocurrency and Blockchain” at Hong Kong Baptist College.

For extra on the newest in enterprise reads, click on right here.