The used automotive market is displaying clear indicators of renewed energy and resilience, in response to recent knowledge from AutoTrader, signalling a optimistic trajectory because the sector heads into the second half of the 12 months.

Buoyed by sturdy shopper confidence, secure costs, and quick turnover, July marked a major turning level, with each provide and demand dynamics aligning to create a wholesome and aggressive market setting.

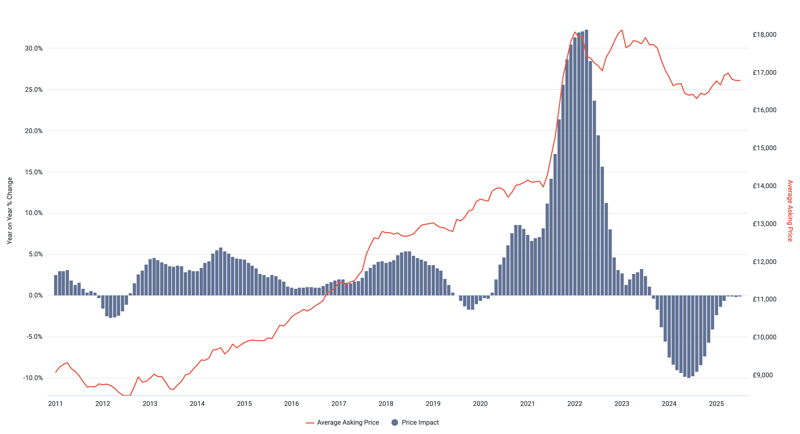

Primarily based on round 800,000 retail market pricing observations, the common worth of a used automotive in July was £16,786 – flat on each a month-on-month and year-on-year foundation. This marks the fourth consecutive month of YoY worth stability, following 19 months of decline, and highlights the sector’s return to a extra balanced footing.

AutoTrader’s Market Well being metric additionally mirrored this energy, posting its first upturn since January. The metric rose 1% YoY, constructing on an already strong 8% development in July 2024. This enchancment has been pushed by a slowing provide development fee of +1.1% YoY, which mixed with 2% development in demand, has offered a fertile panorama for restoration.

A key signal of this momentum is the quickening tempo of car turnover. In July, used automobiles have been bought on common each 29 days, which is someday quicker than July 2024, and three days faster than July 2023 – a transparent indicator of rising shopper urge for food.

AutoTrader’s newest shopper analysis helps this development. Almost 44% of 1,000 respondents surveyed in July mentioned they felt “far more” assured about affording their subsequent automotive in contrast with final 12 months. Moreover, in a separate research of over 2,000 individuals, roughly 70% mentioned they intend to buy a car throughout the subsequent six months.

This rising intent is mirrored in digital engagement: AutoTrader recorded round 85 million cross-platform visits in July, up 5.7% YoY and marking its greatest July viewers on report. This follows related record-breaking numbers in each Could and June, reinforcing the market’s sturdy ahead momentum.

This confidence is translating immediately into gross sales. AutoTrader knowledge reveals the used automotive market grew 3.3% YoY in July. Nonetheless, efficiency differed between retailer varieties. Impartial retailers noticed a 6.1% improve in gross sales, whereas franchise retailers remained flat at 0.1%.

The divergence is partly attributable to car availability. The provision of three–5-year-old automobiles, a key section for franchised sellers, has dropped sharply because the pandemic. Provide chain disruptions that endured till mid-2023 have taken a long-lasting toll, with quantity falling from 4.8 million in 2019 to a projected 2.9 million by the top of 2025.

In distinction, unbiased retailers have been much less uncovered to those provide shortages. They’ve benefitted from elevated demand for older, extra reasonably priced automobiles, with curiosity in 5–10-year-old automobiles up 3% YoY, and demand for automobiles over 10 years previous climbing 8.6%.

Commenting on the information, Marc Palmer, head of technique and insights at AutoTrader, mentioned: “The mix of swift gross sales, growing website visits, and secure pricing underscores a dynamic and resilient sector, which ought to present confidence for retailers because the market heads into the rest of 2025.

“Nonetheless, there stay important nuances and challenges available in the market round provide, which is making the job of discovering worthwhile automobiles more and more extra aggressive. Utilizing the information and insights out there to assist supply and worth new inventory has by no means been extra necessary, notably the place conventional inventory profiles have been impacted.”

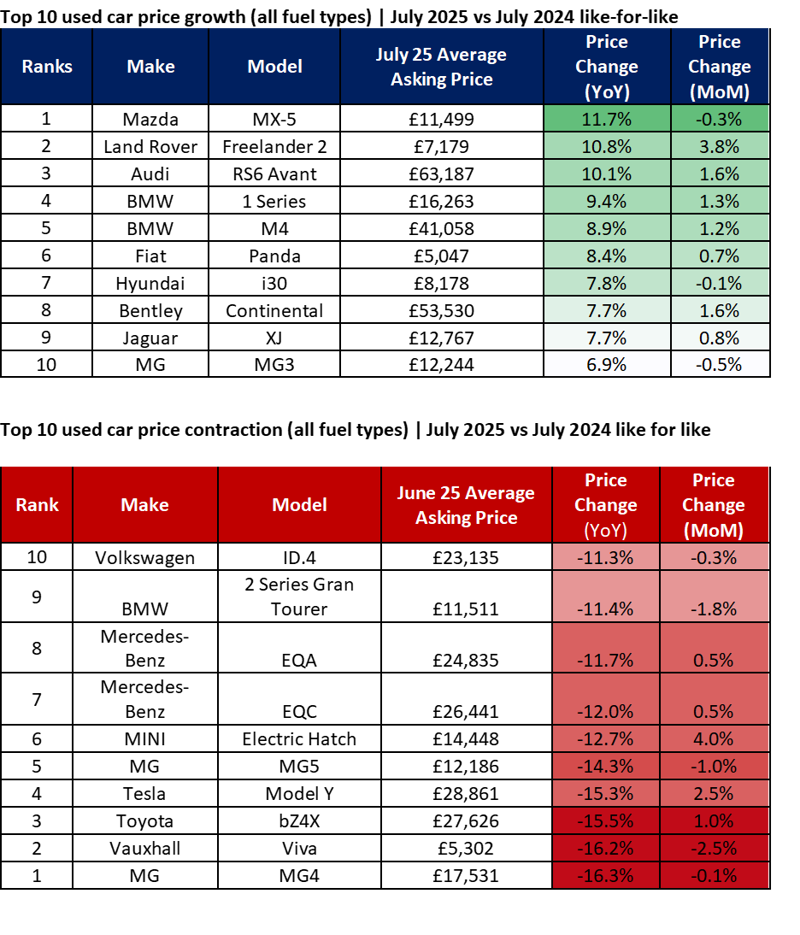

Probably the most notable development areas continues for use electrical automobiles (EVs). Provide surged 42.4% YoY in July, up from 38.1% in June, whereas demand grew 37.8%, accelerating from 28.6% the earlier month. With provide solely simply outpacing demand, used EV costs are stabilising.

The typical worth of a used EV was £24,727 in July, up 0.4% month-on-month – making EVs the one gasoline kind to see worth development within the month. Though EV costs stay down 6% YoY, this marks an enchancment from the -7.6% decline recorded in June, and is the bottom degree of annual contraction since January 2023.

By way of turnover, used EVs have been among the many fastest-selling gasoline varieties, taking simply 28 days to promote – on a par with petrol automobiles. That’s a pointy enchancment from the 32 days in June, when EVs have been the slowest-selling section.

This acceleration is partly pushed by shopper response to the federal government’s new £650 million Electrical Automotive Grant. Following its announcement, AutoTrader recorded a 107% week-on-week spike in curiosity for EVs priced beneath £37,000, suggesting that demand within the used EV market may benefit from a long-lasting halo impact.