Fast Info About New Automobile Costs

- Automobile costs are climbing, however supplier incentives are holding them in examine.

- Cox Automotive’s Erin Keating says pent-up demand is generally coming from high-net-worth households.

- Costs stay about $10,000 increased than 5 years in the past.

- Customers might discover nice offers on overstocked automobiles from manufacturers like Land Rover, Ram, Lincoln, Audi, and Mitsubishi, however not essentially on understocked Toyota, Lexus, and Honda automobiles.

In the event you’re available in the market for a brand new automobile, don’t count on to see automotive costs dropping anytime quickly. The excellent news: They’re not climbing a lot both, even with new tariffs in play. Automobile business specialists anticipated a surge in costs attributable to decrease stock, fewer incentives, and added tariffs. Thus far, that spike hasn’t occurred, making it a good time to buy a brand new automotive, particularly as 2026 fashions roll in.

In line with specialists at Kelley Blue E book dad or mum firm Cox Automotive, carmakers haven’t considerably raised the producer’s advised retail costs (MSRPs), automotive shopping for demand is generally coming from high-net-worth households, and authorities insurance policies are nonetheless evolving. So, whereas the market is unsure, you’re not going through a significant automobile value hike — a minimum of for now.

Learn on for professional insights into what’s driving the present pricing strain and what it is advisable know in the event you’re planning to begin your search or purchase a automotive now.

- New Automobile Costs Enhance Modestly

- New Automobile Stock Replace

- Store Round for the Greatest Supply on Your Commerce-in

- The Increased Prices of Automobile Insurance coverage

- What to Anticipate: Trying Forward

New Automobile Costs Enhance Modestly

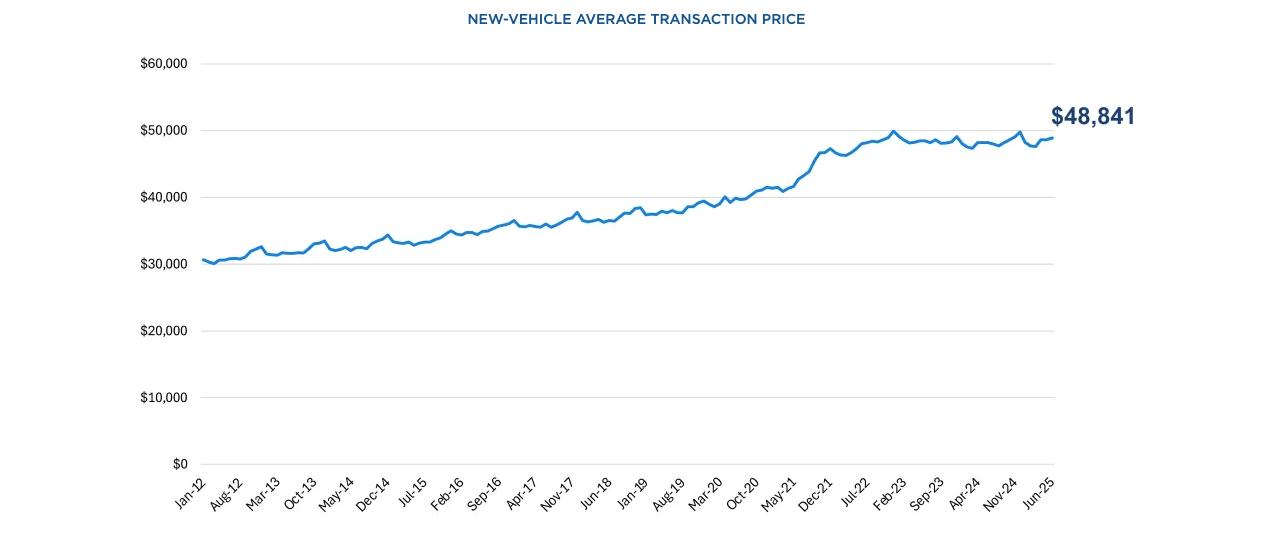

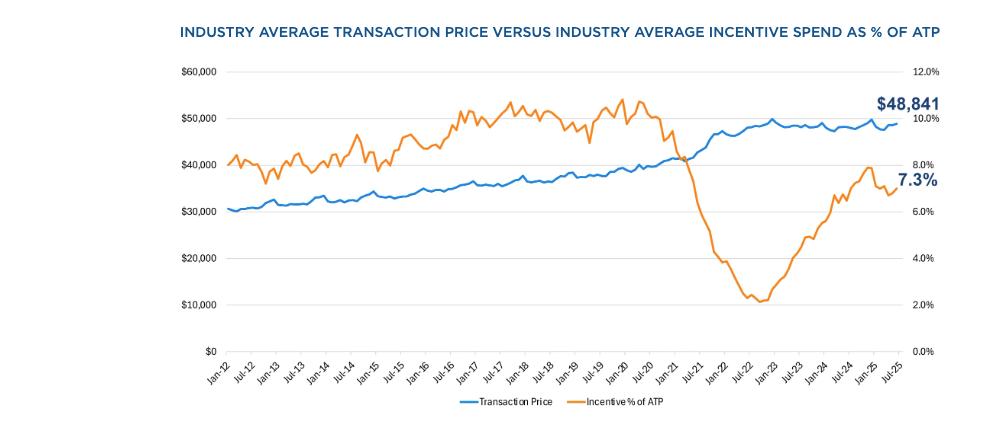

Even because the gross sales tempo started slowing, Kelley Blue E book information reveals common transaction costs have been $48,841 in July, or flat from the month earlier. They rose 1.5% from a 12 months in the past. Incentives to draw customers to new automobiles jumped to 7.3%, or practically $3,550 on common. That’s the best all 12 months.

General, common transaction costs stay about $10,000 increased than in July 2020, because the COVID-19 pandemic gripped the nation. At the moment, the common transaction value for brand spanking new automobiles was $38,563.

“Within the face of rising costs, it’s changing into extra evident that the new-vehicle market is being supported by pent-up demand pushed largely by high-net-worth households,” mentioned Cox Automotive Government Analyst Erin Keating. “These consumers are benefiting from the wealth impact of a wholesome inventory market and stable wage development for the reason that pandemic. On the similar time, automakers are offering wholesome incentives to maintain gross sales flowing. Costs are trending increased, however simply as we’re seeing within the broader retail markets, there’s ample demand and beneficiant incentives on the market, and that’s driving the market.”

The amount-weighted common transaction calculation displays all of the automotive market realities, together with high-volume automobiles, like dear pickup vehicles, influencing the quantity. For instance, the report reveals that full-sized pickups posted a median transaction value of about $64,790.

Electrical automobile affordability improved in July. Customers paid a median transaction value of an estimated $55,689, down 4.2% from final 12 months on the similar time. The nation’s largest electrical automobile (EV) vendor, Tesla, noticed common transaction costs drop 9.1% 12 months over 12 months to $52,949.

“The urgency created by the administration’s resolution to sundown government-backed, IRA-era EV incentives was anticipated to create severe demand for EVs within the quick time period. If final month is any measure: Mission Achieved. July gross sales have been close to an all-time month-to-month document. At this tempo, Q3 would be the greatest ever after which some, as consumers leap in earlier than the massive incentives dry up.”

What Drives New Automobile Costs

- Stock availability

- Producer incentives

- Supplier reductions

- Commerce-in automobile worth

New Automobile Stock Replace

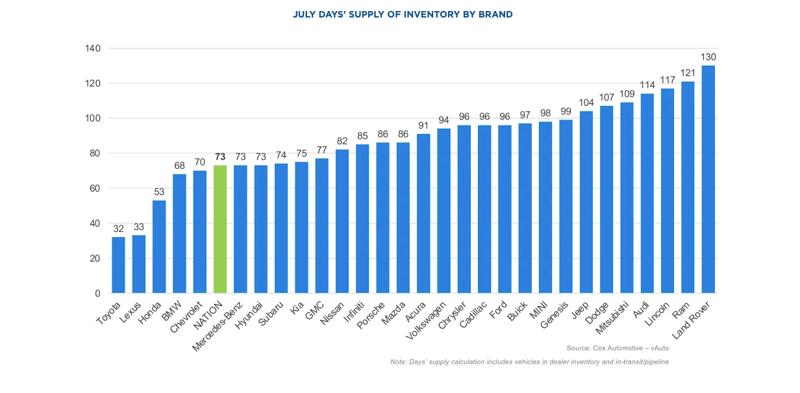

In line with Cox Automotive’s vAuto Stay Market View, new automotive stock dropped barely in July in contrast with the earlier month. Dealerships started August with a 73-day provide of automobiles, a 4.7% drop in comparison with a 12 months in the past, although only one% lower than final month.

Dealerships observe the variety of new automobiles they’ve available to promote utilizing a metric referred to as “days of stock,” or how lengthy it will take them to promote out at immediately’s gross sales tempo in the event that they stopped including new automobiles.

In the event you’re out buying proper now, you’ll seemingly discover loads of automobiles from Land Rover, Ram, Lincoln, Audi, and Mitsubishi, although you’re much less prone to discover the precise mannequin it’s your decision from Toyota, Lexus, and Honda. These carmakers have fewer automobiles in inventory at dealerships total.

As new 2026 fashions begin pouring in, dealerships must eliminate the 2025 automobiles. For now, carmakers seem like holding the road on tariff will increase.

Customers heading out to buy a brand new automobile ought to intently monitor dealership pricing amid fluctuating tariffs. Whereas automakers set the stage for pricing, sellers in the end shut offers. They might simply add markups or increased supplier charges to compensate for any losses they may incur attributable to tariffs alongside the best way.

For now, we propose new automotive consumers seek for incentives and cash-back offers and broaden their buying boundaries to seek out the precise deal for his or her price range. Certified consumers with stellar credit score will uncover low-interest-rate provides and lease offerstogether with on electrical automobile fashions, a few of which lose the $7,500 federal tax credit score on Sept. 30.

Credit score-worthy consumers can safe offers on SUVs, like a 2025 Nissan Rogue with 0% APR financing for as much as 60 months, good via Sept. 2. Moreover, $1,750 money again is obtainable.

Store Round for the Greatest Supply on Your Commerce-in

Commerce-in worth is one other issue driving automotive costs. An absence of used automobile inventory has stored these costs increased, giving credence to the concept shopping for a brand new automobile might generally be cheaper than buying a sure used mannequin, only some years outdated. In consequence, it’s nonetheless a good time to commerce in your automotive.

Sellers worth your trade-in partly primarily based on what they want in inventory. On the flip facet, they’re extra prone to supply a wonderful deal to consumers on a automotive that fewer individuals are in search of presently. In different phrases, a automotive shopper buying and selling a 2018 Honda Civic for one thing else will probably be a lot happier with the trade-in appraisal than one with a 2021 Jeep Grand Cherokee.

Automobile consumers ought to put together to buy their trade-in round. It’s barely extra difficult to tug off, however promoting your outdated automobile to at least one dealership and shopping for your new automotive from a unique one might make sense if the ultimate bill numbers work out in your favor. Use the Kelley Blue E book Prompt Money Supply instrument to buy your trade-in automobile at close by dealerships. While you let the offers come to you, choosing the right trade-in supply to your scenario is simpler. Bear in mind, you possibly can at all times negotiate the supply, and pitting one supply towards the opposite will not be extraordinary when buying round for a automobile.

The Increased Prices of Automobile Insurance coverage

With tariffs on imported automobiles and a few automotive elements, it’s seemingly auto insurance coverage charges will climb increased, whilst automotive homeowners are already stretched to their limits on insurance coverage prices. In line with the Bureau of Labor Statisticsautomotive insurance coverage prices have been 5.3% increased in July than a 12 months earlier. Bankrate says automotive insurance coverage prices a median of $2,679 a 12 months for full protection. Full protection, referred to as complete automotive insurance coverage, covers pure disasters like wildfires, hurricanes, floods, and accidents. Earlier than you seal the deal and signal something for a brand new automobile, examine quotes for automotive insurance coverage.

What to Anticipate: Trying Forward

Trying forward, count on a chaotic car-buying future. Economists initially forecast two rate of interest cuts in 2025, after three final 12 months. Nevertheless, it’s anybody’s guess what might come, or nothing in any respect might occur. On the Federal Reserve assembly in July, the nation’s central financial institution held charges regular.

Cox Automotive analysts count on new automotive costs to interrupt the $50,000 barrier later this 12 months.

“The auto business is clearly underneath strain. Tariffs are rising prices throughout the board for automakers, sellers, and shoppers — not just for new automobiles, however for aftermarket elements and insurance coverage prices,” mentioned Cox Automotive’s Keating. “As Cox Automotive has famous, tariffs on cars and vehicle elements contribute to inflation and pose a problem for an business already going through stagnant development, partly attributable to affordability points.”

RELATED: Unhealthy Credit score Automobile Loans: All the pieces You Want To Know

What to Do If You Want a Automobile Now

If buying now, search for overstocked 2025 fashions that automotive dealerships wish to promote shortly to make room for the incoming 2026 automobiles. Producers seem like holding the road on sharply rising costs attributable to tariffs, and that’s nice information in the event you’re available in the market to purchase a brand new automotive proper now. Earlier than shopping for:

- Analysis your choices and broaden your boundaries if wanted.

- Search for offers, particularly on 2025 fashions, as 2026 automobiles begin pouring in.

- Store forward for a automotive mortgage in the event you’re not paying money.

RELATED: Paying Money for a Automobile in 2025: Think about the Execs and Cons

Editor’s Notice: This text has been up to date for accuracy because it was initially printed.